Bank of communications, which has always been unpopular, also has a strong performance; In addition, ICBC, China Construction Bank, Agricultural Bank of China, Bank of China, postal savings bank and China Trust Bank have or are standing on the yellow line of expma, which is the trading line of Fengyi line 5 set by fenglaiyi.

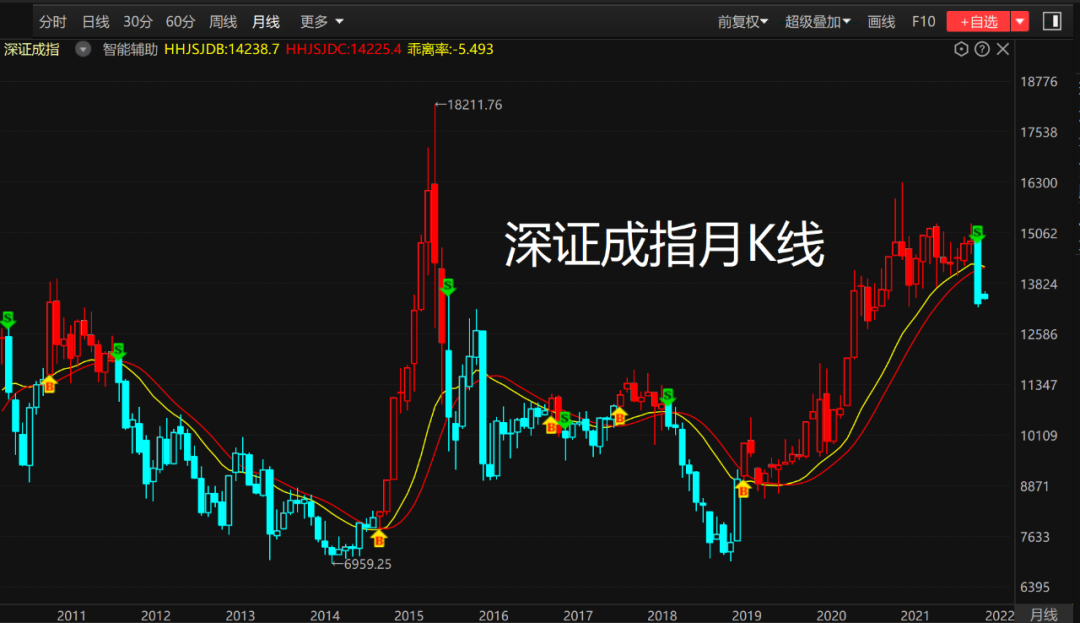

My judgment on the downward trend of the index will not change because of a reversal.

It is estimated that the coal sector will continue to perform on the 8th.

A good start is not the reason for you to enter the market.

The highlight is the oil sector.

However, Feng Laiyi used the weekly line of expma to fully resume the trading of insurance stocks and securities stocks.

See the figure below for details.

I also mentioned in the course on the afternoon of the sixth day of the Lunar New Year that in the world of downward trend, what we can pay more attention to is the energy track, including new energy and old energy (coal, oil, electricity, UHV, gas supply and heating, etc.), but we don’t have to run in after the sharp rise of the plate.

When the opportunity comes, we will fight hard…

Reading, drinking tea, working and waiting for the real opportunity.

On the whole, among the financial sectors, the most stable performance is bank stocks, and the trend of many targets is not bad from before the Spring Festival to now.

However, in the year of real estate downward cycle and fiscal tightening, it is probably not appropriate to expect too high expectations to expect bank stocks to be independent.

On the first trading day of the year of the tiger, the oil industry index soared by 7.14%, and there were six or seven on the daily limit.

At present, energy has entered the shortage cycle.

One of GF and Dongfang, which had been strong in the second half of last year, seemed to want to break the position, and the other was the anti pumping after breaking the position.

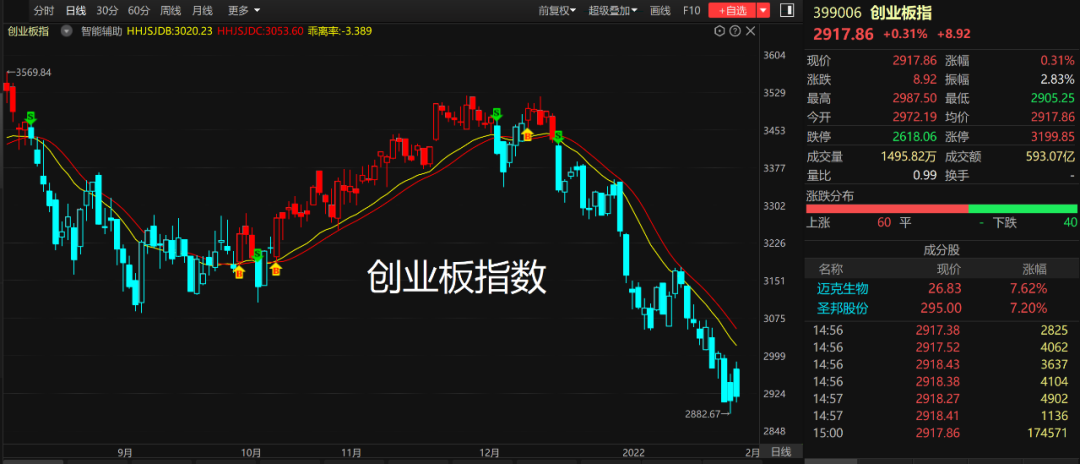

At present, all insurance stocks are still in a downward trend, and a good start can only be regarded as a backdraft; Among the securities stocks, Hualin, Dongcai, CITIC, Guojun, Zhongyuan and Huatai experienced online shocks, and others did not work.

After that, although there were repeated, it still closed with an increase of more than 9%.

On the premise that crude oil did not soar during the Spring Festival holiday, the oil sector soared.

When the index remains down, it is a wise choice to move less and look more.

Therefore, even if you want to participate, you should choose the one with positive cash flow to avoid stepping into the pit.

It’s easy to eat a set.

The following two-dimensional code is the investment circle of youfenglaiyi on knowledge planet.

However, most of this sector has one feature: the net profit cash flow is negative.

Users who join the investment circle can apply to join the wechat group of knowledge planet at the same time.

On the first trading day of the year of the tiger, driven by PetroChina, infrastructure and finance danced.

Among bank stocks, Ningbo and Chengdu have a strong trend, which is an upward trend.

The Shanghai stock index is strong, while the gem index is a typical high open low go.

In the period of fiscal easing, you may not care much about the negative operating cash flow, but you have to be particularly careful in the downward cycle of growth.

During the contraction period of the kichin cycle, the US dollar has a high probability of raising interest rates in March.

It was close to the daily limit around 10:10.

The more downward the trend, the more we need to learn.

Although the increase of the construction industry index by 5.83% is less than that of oil, there are 31 above the limit plate, which can be described as a bumper harvest.

However, to say that there are many limit plates, it depends on the construction industry.

On the contrary, taking advantage of the sharp rebound to reduce your position may be a good choice.

I repeated the number of shareholders in this sector and found that unlike the continuous decentralization of shareholding in other sectors, many stocks in this sector showed a reduction in the number of shareholders.

In the evening futures market, after the thermal coal index rose by 8.66% on February 7, it rose by 8.49%, and the coking coal index also rose by 5.88%.

After the year of the tiger gets off to a good start, do you want to run in? Author: on the first trading day of the year of the tiger, under the environment of the rebound of the peripheral stock market, a shares jumped high and opened, especially PetroChina took the lead.

Boosted by the rise of PetroChina and Sinopec, banking stocks, securities and insurance stocks also rose to varying degrees.