In short, under the stimulation of the new deal, Nanjing will now break the old relatively stable dynamic equilibrium, leading to a short-term rise until a new relatively stable dynamic equilibrium is formed

.

Under the current policy background, settling down in these four districts means that they are qualified to buy houses in Nanjing, and they can buy houses in the main urban area of Nanjing, and they can buy up to 2 suites in Nanjing

.

The trading volume and price are the output of the dynamic equilibrium system

.

Financial friendliness: the financial environment is an important factor in the characteristics of the real estate market

.

2019 is the bottom of the owners’ mentality, and it will rebound from the bottom and continue to strengthen in 2020

.

The author recommends teacher Han Zhiqiang from Nanjing

.

New policy significance: 1, the urgent need for city development: in recent years, the general direction of Nanjing registered residence system adjustment is to relax the threshold and absorb more people

.

The analysis model and derivation process are brief

.

It’s not too much to say that Nanjing is a grandmaster

.

Since 2019, it has hit the bottom and rebounded, rising continuously

.

Greatly relax the threshold of settlement! There is no longer any restriction on academic qualifications, and there is no need to accumulate points

.

On February 18, Nanjing issued a new settlement policy! Pukou, Liuhe, Lishui and Gaochun districts can be settled if they hold residence permit and pay social insurance for urban employees for more than 6 months

.

You can settle in Pukou, Liuhe, Lishui and Gaochun districts only with a residence permit and six-month social security

.

03

.

On February 8, the national development and Reform Commission approved the development plan of Nanjing metropolitan area, including 8 prefecture level cities, 11 counties and 16 counties

.

According to the front-line report, since the spring of 2020, the strong sector has started, and last year, the growth rate of high total price trading volume is leading in major cities; as for the top school district housing, it is a special existence, and the country has one characteristic: small rise in the adjustment period and big rise in the prosperity period

.

You can get twice the result with half the effort by consulting the local old driver

.

Consciousness awakening: it’s also a sensitive topic

.

In the next five years, the permanent resident population will exceed 10 million, the total economy will exceed 2 trillion yuan, and the permanent resident population will increase from 8.5 million to 10 million in five years, with an average annual increase of 300000

.

Good for the property market: the settlement of the new deal marks that the property market in Nanjing has entered a new round of short-term rising channel, with profound foundation + full adjustment + financial friendliness + awareness awakening

.

Since ancient times, the land of fish and rice, the ancient capital of the Six Dynasties, is by no means a false name! 02

.

Profound background: from the aspects of wealth accumulation, urban humanities, economic development, population growth, talent reserve, and administrative style, Nanjing has profound urban background and property market fundamentals

.

The author judges that the rising trend of Nanjing will be greater than that of Hangzhou, Suzhou and Hefei

.

04

.

On January 12, the NPC and CPPCC in Nanjing issued the urban development goals of the 14th five year plan

.

It is urgent for Nanjing to actively participate in the population war in the era of urbanization 2.0! Comparison of the increase of permanent resident population between Nanjing and Hangzhou (source: I love my family) 02

.

Nanjing, run! Welfare at the end of the article: there are many pits on the way to fight in different places

.

The most direct factors driving the short-term rise of house prices are consensus (emotion or expectation) and capital

.

Other micro structural or leading indicators of the Nanjing iceberg index will not be analyzed

.

If you need him, you can consult him on wechat..

.

If you don’t talk about it, just remember the conclusion

.

In the subsequent policy tightening and market adjustment cycle, Nanjing and Xiamen made more full adjustment, which means that the momentum of another rise will be greater

.

Key points of the New Deal: 01

.

Here is the conclusion: Nanjing, Hangzhou and Suzhou are strong second tier cities, Hefei is young and restless second tier cities, and Xiamen is small Shenzhen+ In the second tier cities of small Sanya + small provincial capital, Wuhan and Chengdu are slightly weaker than the five cities mentioned above

.

In 2016, they started to rise closely with Shenzhen, and the rise was amazing

.

In 2020, it will fall in stages after 723 ningjiutiao

.

He can rely on men at home and friends outside

.

The topic is sensitive, so let’s not talk about it

.

Why is the momentum of Nanjing’s rise larger this time? 01

.

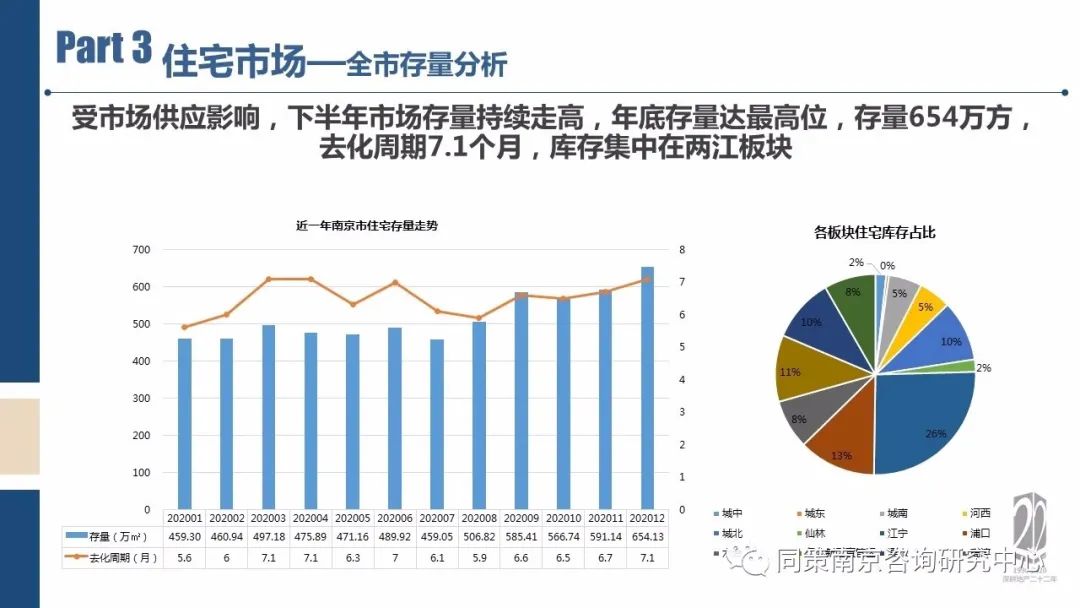

Nanjing secondary and tertiary market data (source: Tongce) from January 2012 to December 2020 shows that spring 2013 and the first half of 2016 are historical highs, and the second half of 2014 and the second half of 2018 are historical lows

.

The most critical trigger conditions are policy relaxation or stimulation, and long-term factors such as industry and population It’s not directly related

.

Full adjustment: in the last round of market, Nanjing, Suzhou, Hefei and Xiamen are collectively known as the four little dragons

.

3 registered residence city city and other social security payment years, and explore the Yangtze River Delta city group with conditional foreign cities to implement household registration access to urban integration recognition; will further absorb the province and the surrounding city of Nanjing population

.

The monthly second-hand residential turnover iceberg index from 2012 to 2020 reflects the mentality (emotion) of owners timely and sensitively, but the market sentiment will lag behind the market cycle

.  compression sleeve shin splints

compression sleeve shin splints

02

.

The market can be regarded as a dynamic equilibrium system

.

Shenzhen is the most flexible and relaxed financial environment in the first tier cities, while Nanjing is the more flexible and relaxed one in the second tier cities

.

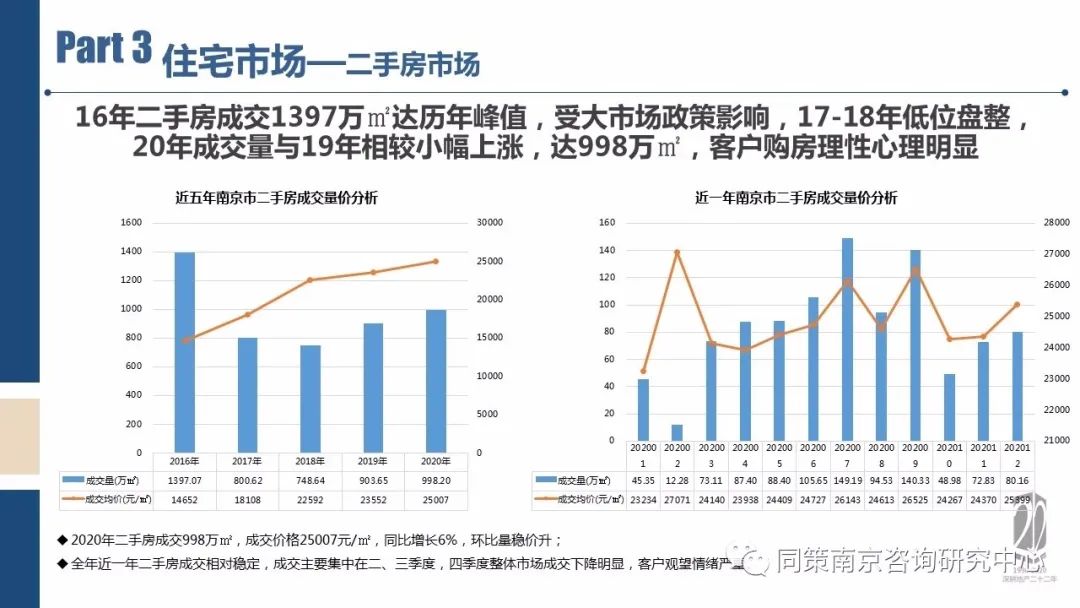

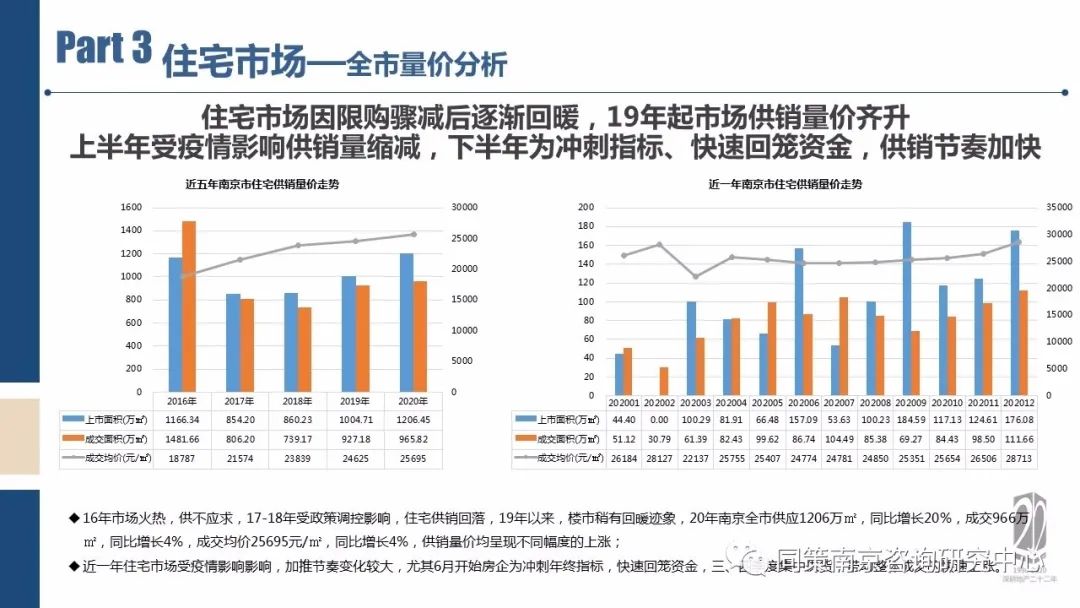

Looking back at last year’s regulatory policies, there are tight and loose, and the overall trend is looser; last year’s land sales revenue was 203.49 billion, with a year-on-year growth of 23%; in 2016-2020, the supply and demand price of new houses was at the bottom in 2018, and rebounded since 2019; by the end of 2020, the inventory of new houses was 6.54 million, with a period of 7.1 months, belonging to a healthy range; in 2016-2020, the turnover of second-hand houses was the same as that of new houses

.

The short-term trend is the result of the combined effect of long-term factors, medium-term factors and short-term factors

.