Shenzhen property market in 2022 – At the beginning of the year, we will review the property market in the past year as usual and look forward to the new year.

There are only two projects that need points.

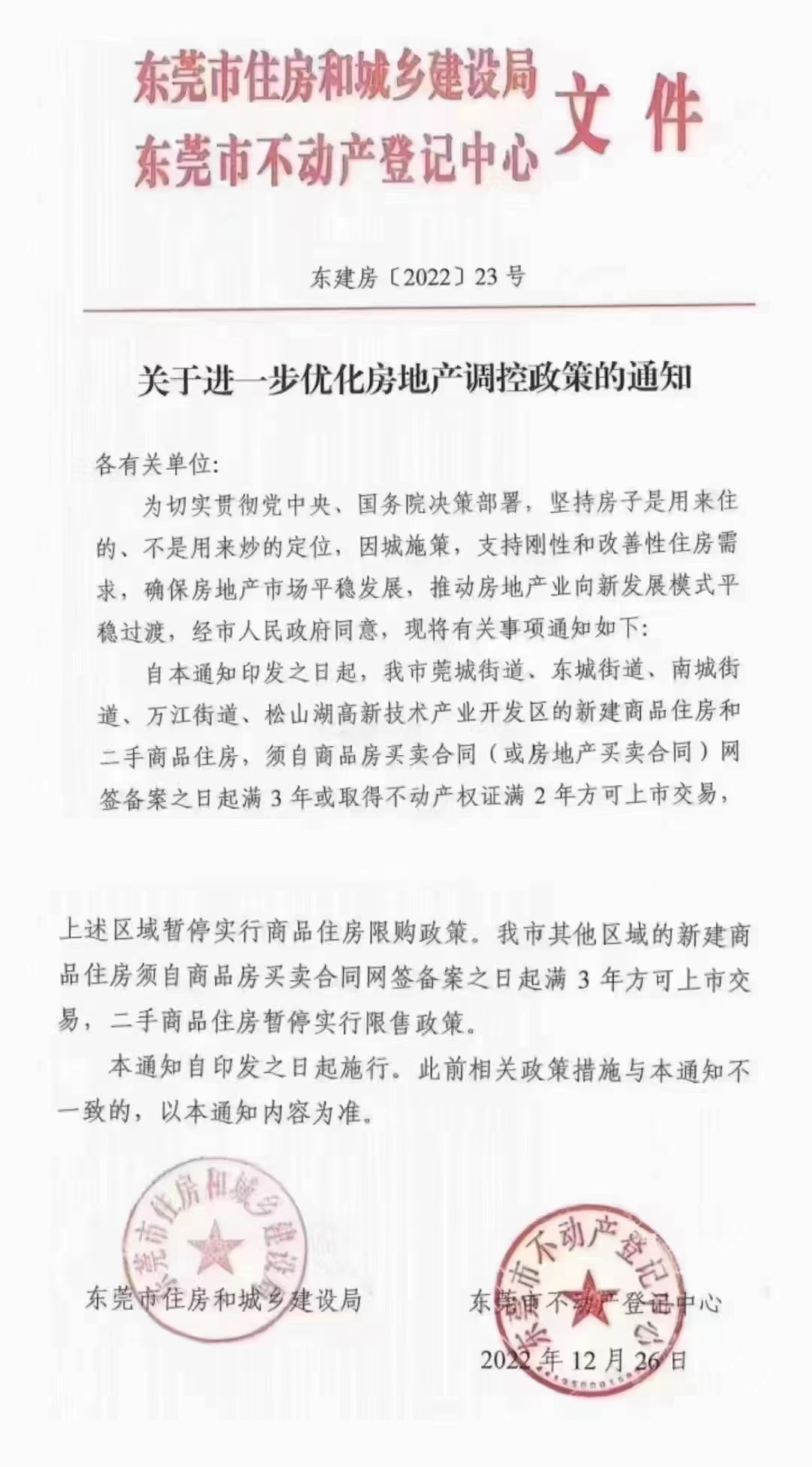

The bottom of the policy has been revealed! Since December, both the Central Economic Work Conference and the comments of some leaders have warmed the real estate industry.

Expectation and demand side aspects.

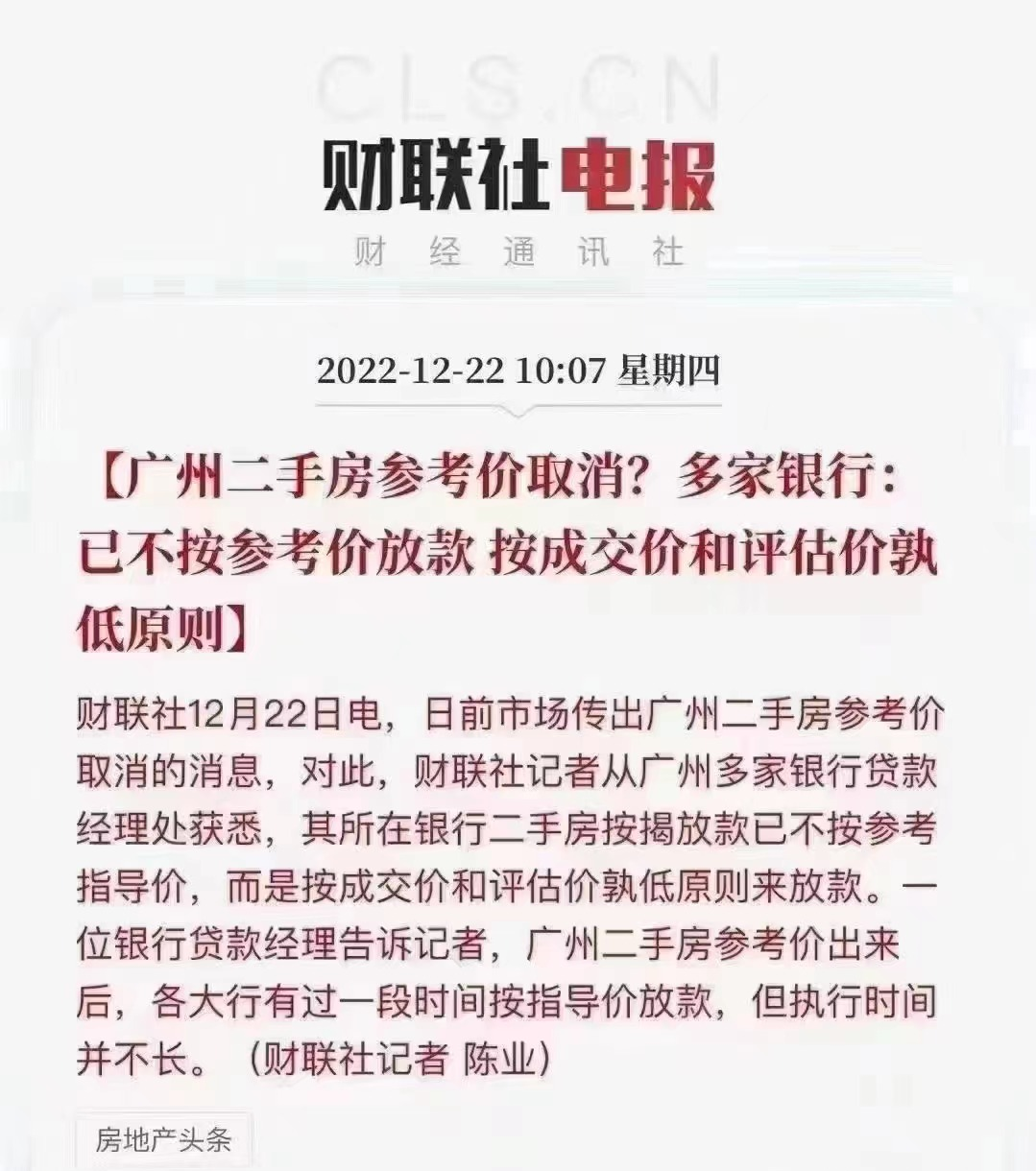

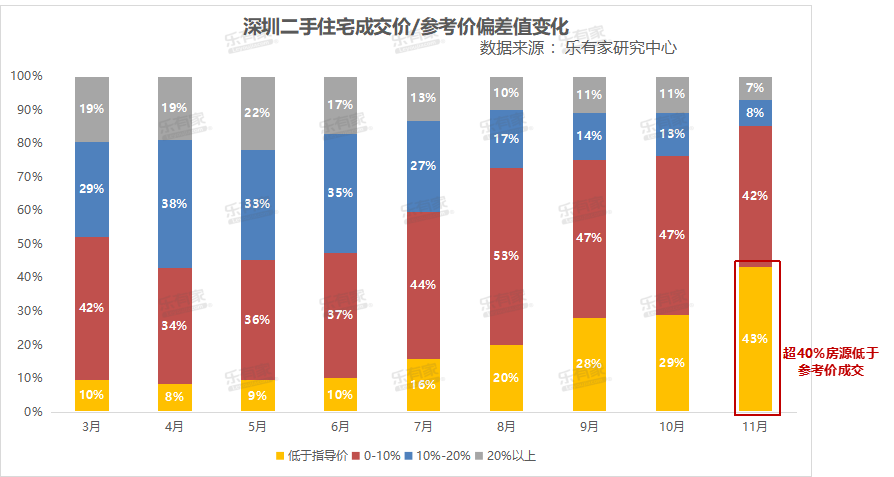

It can be seen that it has become normal for Shenzhen second-hand houses to be traded below or close to the reference price.

95273 second-hand housing units were sold throughout the year, 40699 second-hand housing units were sold in 2021, and 21701 second-hand housing units were sold in 2022.

In a word, in 2022, both the new market and the second-hand market, both the trading volume and the transaction price will decline! 02 Volume II – Corresponding to the decline of transaction, it is the fading of the new atmosphere.

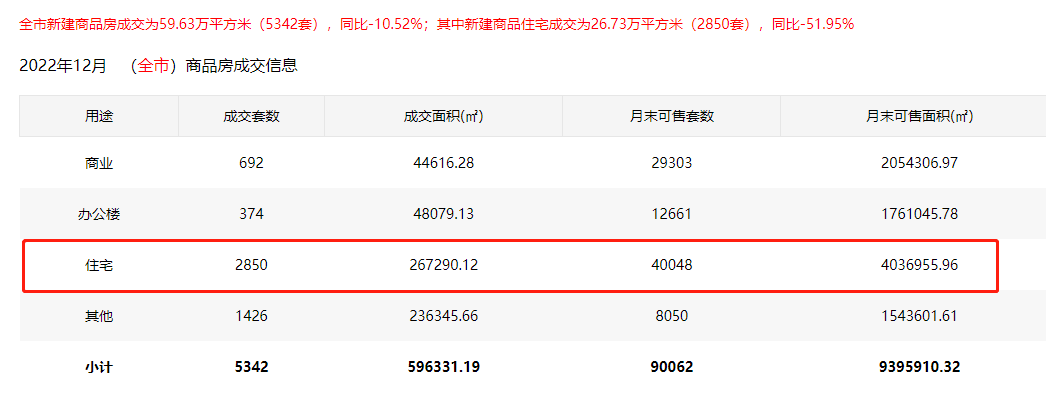

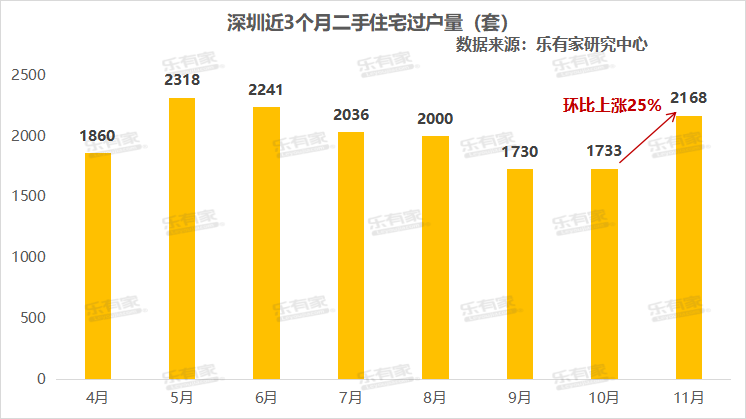

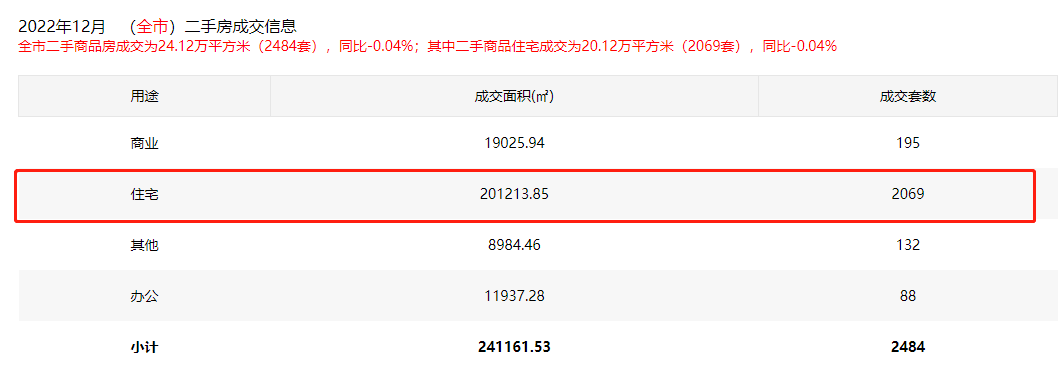

If you want to comment on the Shenzhen property market in 2022 in one word, I think it is “down”! Falling down, falling down! Second hand housing, whether trading volume or price, is down, down; The new market is no longer as lively as it used to be, and it is heavily involved! In the past December, according to statistics from the Housing and Urban Rural Development Bureau, 2069 second-hand houses were sold in Shenzhen, down 99 from 2168 last month! It was originally thought that the turnover of second-hand houses in December could hit 2500 sets.

Assets shrink.

Fortunately, 2000 sets of second-hand houses have been saved in the end! In terms of new houses, 2850 units were sold in December, basically equal to 2790 units in November, up slightly! Looking back to 2022, 34441 new housing units were sold in Shenzhen from January to December, about 35% less than 52417 units in 2021, falling back to the level of 2019! Fall back three years ago overnight! In terms of second-hand housing, the turnover has shrunk significantly.

On the other hand, 2022 may be the best year for buying houses in recent years.

My choice is “cautious bullish” for the following reasons: [1].

We should focus on improving expectations, expanding effective demand, and supporting rigid and improving housing demand.

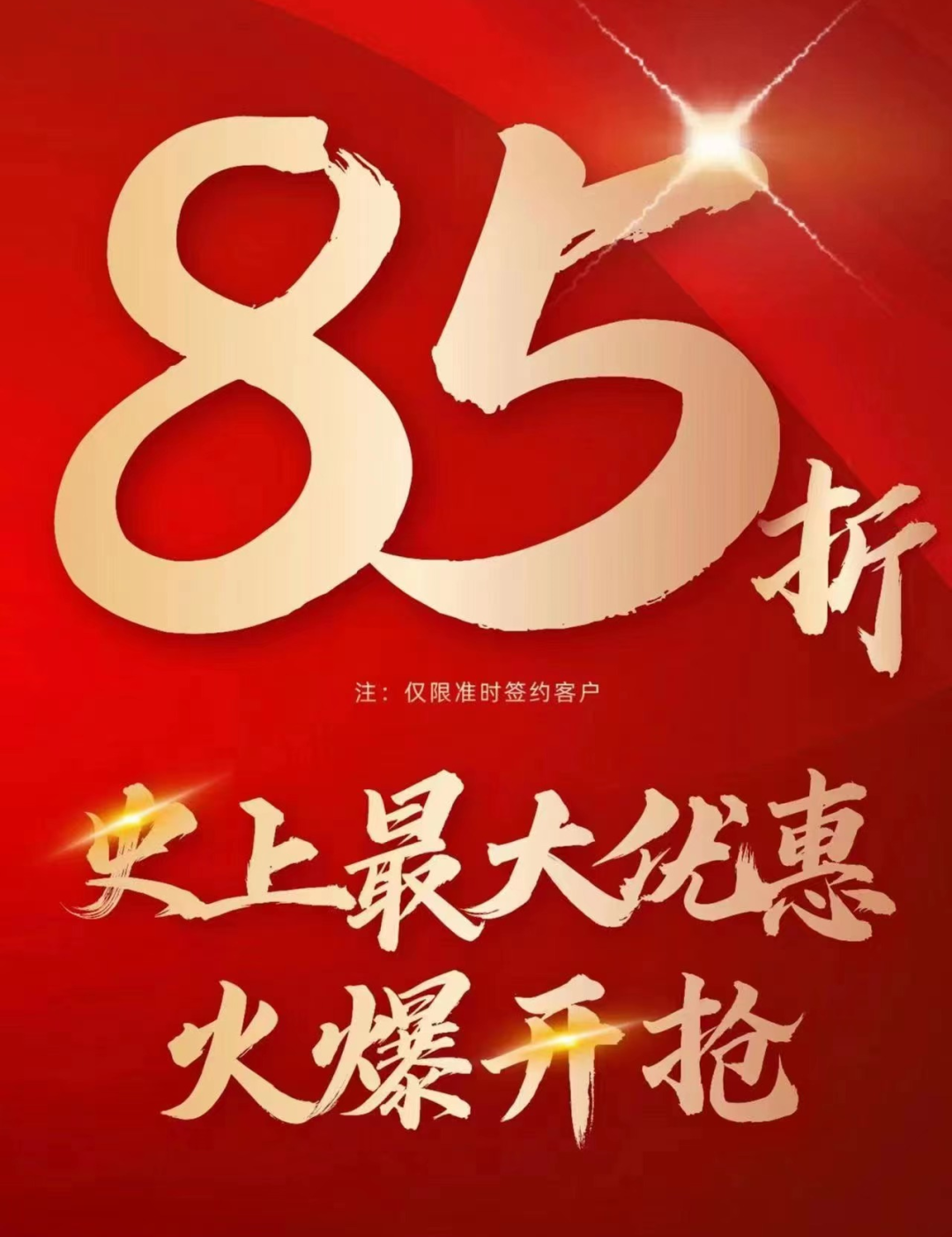

There are agents, with a discount of 92% generally, and a discount of 88% or 86%, with a minimum of 85%.

About 40% thought it would continue to fall, about 30% thought it would rise, about 20% chose to be flat, and others did not express their opinions.

In the past two years, except for some excellent top luxury projects, the vast majority of second-hand housing prices in Shenzhen generally fell back by 20-30%, and the housing prices in most regions returned to 2020 or even 2019! According to the data of Leyoujia Research Center, in November, more than 40% of Shenzhen’s houses were sold at a lower price than the reference price, and the proportion of houses close to the reference price (the difference between the transaction price and the reference price is less than 10%) was as high as 85%.

Considering that there are only more than 20 houses in the late market, there is only one project that needs points throughout the year, that is, Futian Hyde Park! In 2022, even the new market of Qianhai will not need points! Not only is the enthusiasm for innovation no longer strong, but developers are also involved in a serious price war! At present, more than 95% of the new stocks in Shenzhen are sold at a discount.

The year of general decline in turnover and prices is the worst year for Shenzhen’s landlords.

In view of the current downside risks, we have introduced some policies and are considering new measures to improve the industry’s balance sheet situation, leading to a recovery of market expectations and confidence.” The last time that the real estate industry was a pillar industry was in 2003! On December 19, the relevant responsible comrades of the Central Finance Office told Xinhua News Agency and other media reporters that for some restrictive measures in the fields of housing, automobiles, and service consumption, we should improve consumption policies and support consumption such as housing improvement, new energy automobiles, elderly care services, education, medical care, culture and sports services.

For example, in the field of housing consumption, there are still some restrictive policies that hinder the release of consumer demand, and these consumption potentials need to be released..

For example, Xinhua News Agency, Beijing, December 15 — On December 15, the Vice Premier of the State Council said, “Real estate is a pillar industry of the national economy.

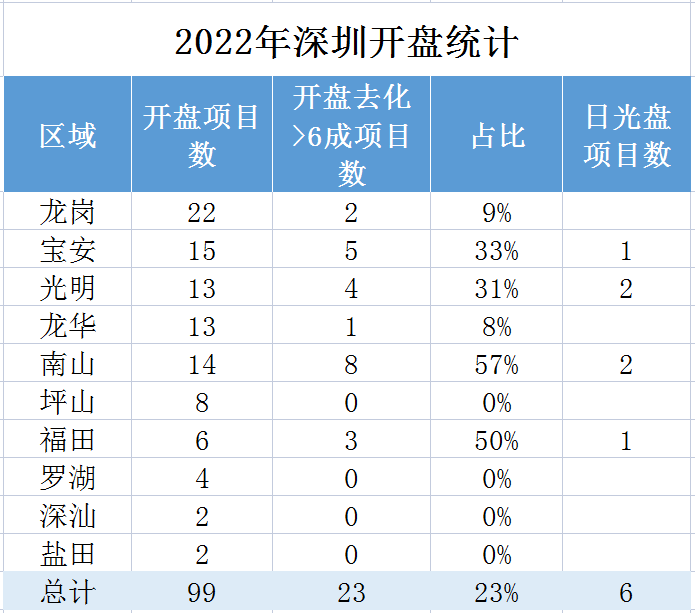

In 2022, Shenzhen Xinpan can be shortlisted without points.

03 May be the best year again—— On the one hand, 2022 is the coldest year in Shenzhen’s real estate market in recent years.

The turnover of second-hand housing has almost halved for two consecutive years! A total of 56142 primary and secondary units were sold throughout the year, a 15 year low since 2007, about 37% lower than the second lowest in history in 2017 (89398 units)! At the same time as the turnover of second-hand houses fell to the freezing point, the average price of second-hand houses in Shenzhen has dropped 25.8% from 77000/m2 in January 2021 to 57000/m2 in November 2022.

2020 is the year with the highest turnover of second-hand housing in Shenzhen.

According to incomplete statistics, as of December 29, there were 100 residential buildings listed in Shenzhen in 2022, of which 23 projects were sold out on the opening day, and only 6 projects were sold out on the opening day.

Second hand generally fell, most of which fell back two years ago, including some high-quality houses in hot spots! Shenzhen just found to their surprise that they could not afford a house before, but now they suddenly found that they could afford it! 042023, bullish – On the first day of the New Year, I made a survey on microblog with the theme of “Shenzhen property market will fall or rise in 2023”.

There are price limits and discounts for new listings, and no points are required.

However, due to the recent epidemic, the flow of people has decreased significantly, and the second-hand houses have also suffered a great impact.

The turnover has plummeted.

Compared with the performance of 29 “daily CDs” in 2021, it is less than a fraction of that in 2021.

For example, Qianhaichen Bay and Vanke Future Light; Even new markets in Qianhai have discounts, such as Vanke Zhenwanyue.

As of the position at the time of writing, 6357 people participated in a few days.