Those brands who submitted the prospectus in the first half of the year but failed to hit the target at once also quickly started the journey of secondary impact on IPO.

At the same time, the attention of big brands to DTC strategy and the resulting strong growth have made domestic players see the opportunities in this model..

Can’t we escape the “strange circle” of new consumption? According to the prospectus, Jiaoxia adheres to the DTC omni channel model in terms of channels.

In addition, thanks to the popularity of sunglasses and masks, the revenue share of accessories series also rose from 5.3% in 2019 to 25.4% in 2021, becoming the second pillar category, still ranking second in the first half of this year.

From the perspective of the prospectus, the strategy of multi category parallel under Jiaoxia has achieved some results.

Take the recently updated prospectus of Jiaoxia as an example.

Behind the “urban outdoor” vent, as a representative of new consumer brands, why can Jiaoxia break the overall decline of the industry this year, and in what areas should it add weight if it wants to impact the IPO? This paper will interpret these issues.

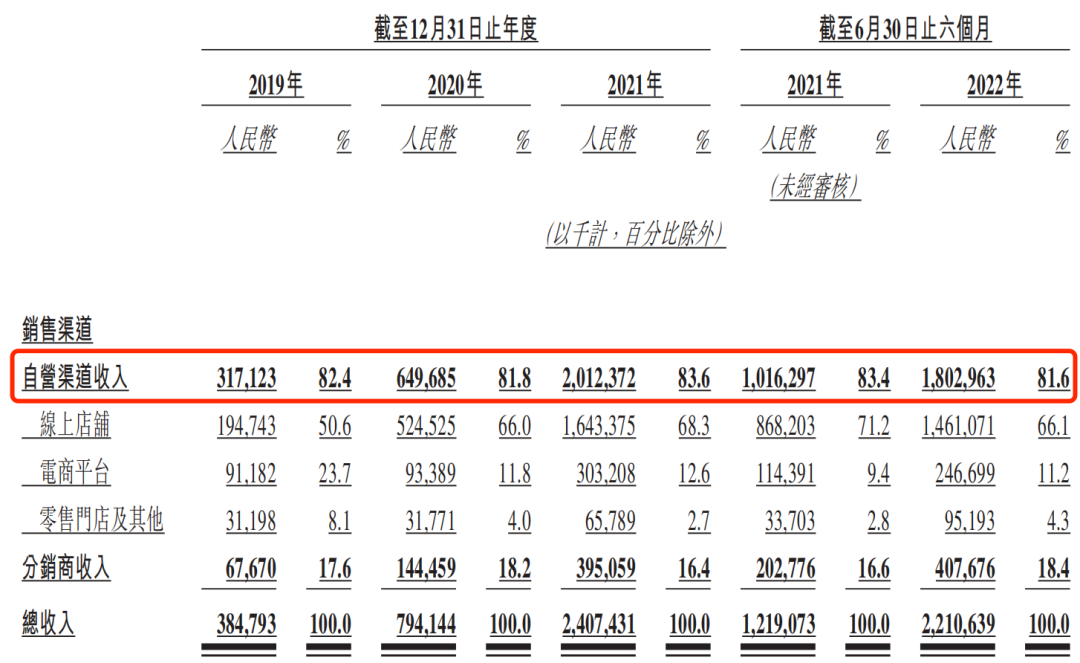

Since 2019, more than 80% of the revenue of Jiaoxia has come from online self operated channels.

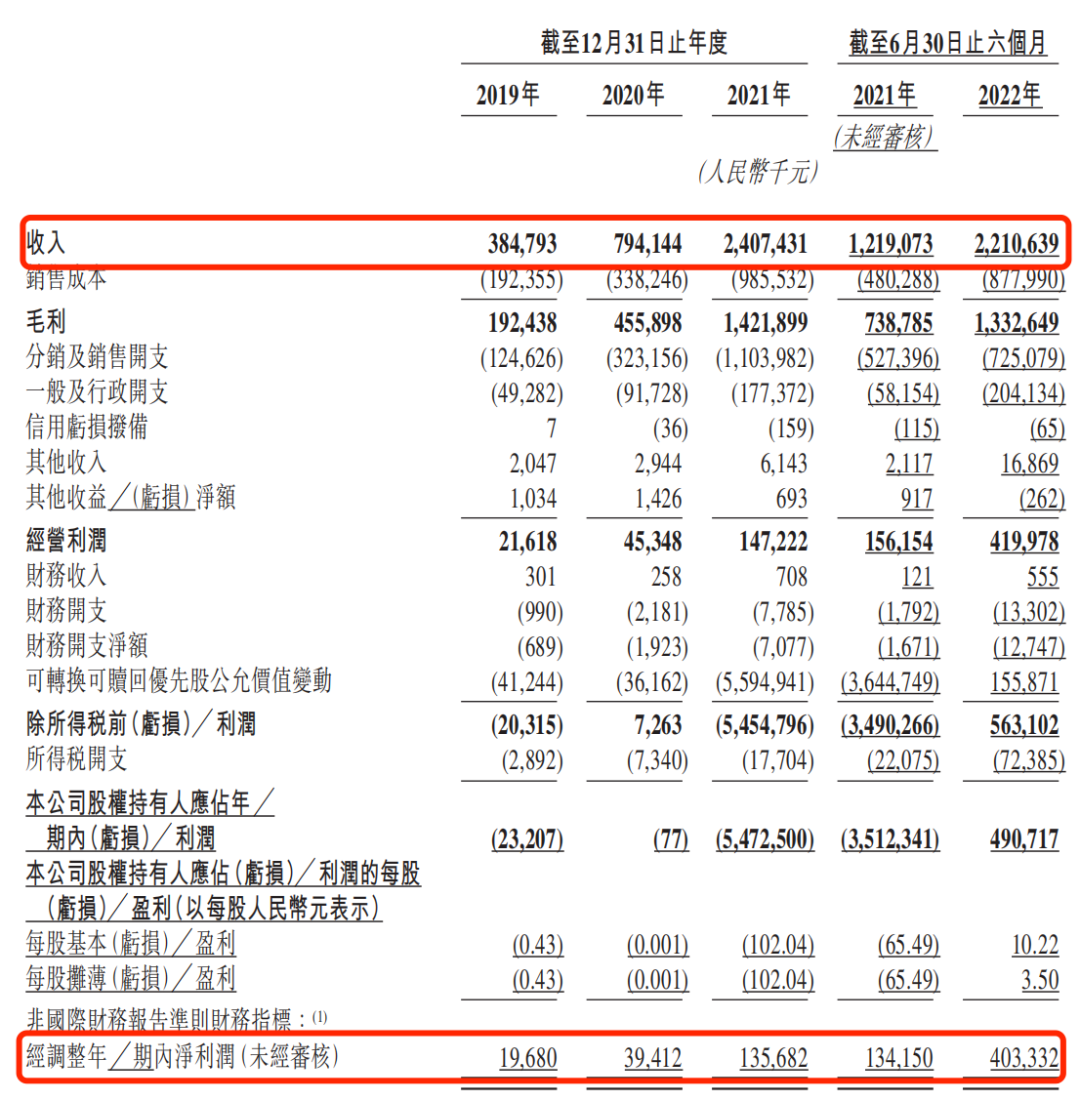

In the first half of 2022, the revenue will reach 2.211 billion yuan, with a year-on-year growth of 81.3%, which is close to the level of last year.

From 2019 to 2021, the revenue under plantain increased from 385 million yuan to 2.407 billion yuan, with a compound annual growth rate of 150.1%.

This trend has continued in the first half of this year.

Among them, there are some famous brands such as Jiaoxia, Keep, Delta China, and Tuhu Yangche.

What is the future of those “under the banana” who have impacted IPO twice? To answer this question, we should return to the development of the enterprise itself.

The clothing category, which accounted for only 0.8% of the revenue in 2019, will replace the umbrella and become the first pillar category by 2021.

In addition to the sun protection series, the clothing products under banana have been expanded to the non sun protection function series such as warm keeping, home and sports.

The revenue contribution rate will increase from 0.7% in 2019 to 20.6% in 2021.

In terms of category, Jiaoxia first started with sunscreen umbrella.

In terms of profit, Jiaoxia’s net profit in the first half of 2022 reached 491 million yuan, while the net loss in the same period last year was 3.512 billion yuan, mainly due to changes in the fair value of convertible redeemable preference shares.

From 2019 to 2021, the revenue under plantain increased from 385 million yuan to 2.407 billion yuan, with a compound annual growth rate of 150%.

The original author of Kaiboluocaijing | Su Qi editor | Jin Yufan experienced the first half of the year full of “cold weather”, and the whole Hong Kong stock market welcomed signs of recovery.

This sends a signal to the outside world that Jiaoxia is a company with strong growth and profitability.

If the changes in fair value are deducted, from 2019 to 2021, the adjusted net profits of Jiaoxia will be 19.68 million yuan, 39.41 million yuan and 136 million yuan respectively, with a compound annual growth rate of 162.6%.

It has created classic popular products such as sunscreen small black umbrellas, sunscreen clothes, masks, sunglasses, and has gradually expanded to non sunscreen products.

For example, Anta announced in August 2020 that it would carry out DTC transformation.

In the first half of 2022, the figure will be 403 million yuan.

It can be seen that the profitability of Jiaoxia is continuously improving, and the profitability of Jiaoxia is related to its insistence on self operation at the channel level and expansion of categories at the product level.

Internationally renowned sports or leisure clothing brands such as Andema, Nike, Lululemon, etc.

have started to use DTC mode for a long time, while domestic sports brands have only started to try this mode in recent years.

It has launched explosive products such as outdoor tights, thick soled canvas shoes, and has made a way out of leisure and sports players such as Uniqlo and Lululemon, and has gone to Hong Kong to attack the “first wave of urban outdoor”.

Even when new consumer brands are generally cold, the revenue still keeps growing.

As of the first half of this year, Jiaoxia has continuously incubated several product lines, and the product income structure has also changed greatly compared with 2019.

According to the prospectus data, the revenue of Jiaoxia has kept growing for three consecutive years, and the profit scale is also expanding year by year.

Li Yingtao, a senior analyst in the brand retail industry of Analysys, pointed out that the data proved that the anti risk ability of the product structure under Jiaoxia is gradually strengthening, but how to maintain the long life cycle of the product is what Jiaoxia needs to think about in the process of constantly creating explosive products.

The scale of revenue in the first half of 2022 will reach 2.211 billion yuan, which is close to the level of last year; The adjusted net profit increased from 19.68 million yuan to 136 million yuan, reaching 403 million yuan in the first half of 2022, and the net interest rate reached 18.2%.

From the perspective of channels, Jiaoxia has always been dominated by self operated channels, which can not only strengthen the brand image, but also stabilize the price system.

As an urban outdoor brand, Jiaoxia has entered the market with sunscreen umbrellas.

As an urban outdoor sports brand that has firmly followed the DTC path from the very beginning, Jiaoxia is rare.

Its non sunscreen product revenue has increased from 2.8 million yuan in 2019 to 76.5 million yuan in 2020, and will further increase by more than five times in 2021, reaching 496 million yuan.

How can the multi category combination be sustainable? The updated prospectus of Jiaoxia shows that its revenue and net profit have maintained a high growth in the past three and a half years.