Today’s operation is a new one: buy a new teacher of 70.07 million China mineral resources, When the short – term sentiment continued to show the effect of losing money, China Mining Corporation further widened the height with the help of good news, which made the plate have the sign of a small climax today.

Meanwhile, the downstream installed price has exceeded 1.9 yuan / W, and the downstream tolerance of the industry has significantly increased the operating rate of the whole industry.

Southwest Securities Zhejiang Branch: buy $76.45 million.

There is no famous seat in the main hot money direction of today’s hot money list (transaction > 100 million).

It was very active when frying non-ferrous metals last year.

The Shenzhen composite index fell by 1% at one time, and then began to shake up, and the three major indexes turned red in the afternoon.

In a word, it is not suitable to buy at a high level.

The point of the game here is the rebound after the short-term continuous freezing point, superimposed with the resumption of trading in Zhejiang construction investment tomorrow.

Funds continue to buy this sector mainly because the price of lithium carbonate is still rising.

Summary of the dragon and tiger list: the three major indexes rose and fell differently at the opening, but after the opening, the whole line dived and killed.

If there is no first hand, it will wait for the opportunity of low absorption on the 5th line.

2) the price of silicon material and installed capacity have increased simultaneously.

We have also analyzed the fundamentals of lithium ore before.

At present, there is no sign that the bull stocks to which the popularity is directed have peaked, and the trend can be compared with the well – off shares in April last year.

From the disk view, many funds are buying with large sums of money.

Now the opportunity is here.

There is negative sentiment, and try to make up as much as possible.

Otherwise, it can wait for the decline to consider intervention.

On February 24, the average price of battery grade lithium carbonate in East China was 458000 yuan / ton, up 19.9% compared with the average price at the beginning of the month..

Up to now, the total capacity of photovoltaic module centralized procurement projects of central state-owned enterprises in 2022 has exceeded 45gw, exceeding last year’s procurement capacity.

3) the latest 2022 domestic component bidding market has received frequent good news.

I emphasize it, A lot of news in it may affect your tickets.

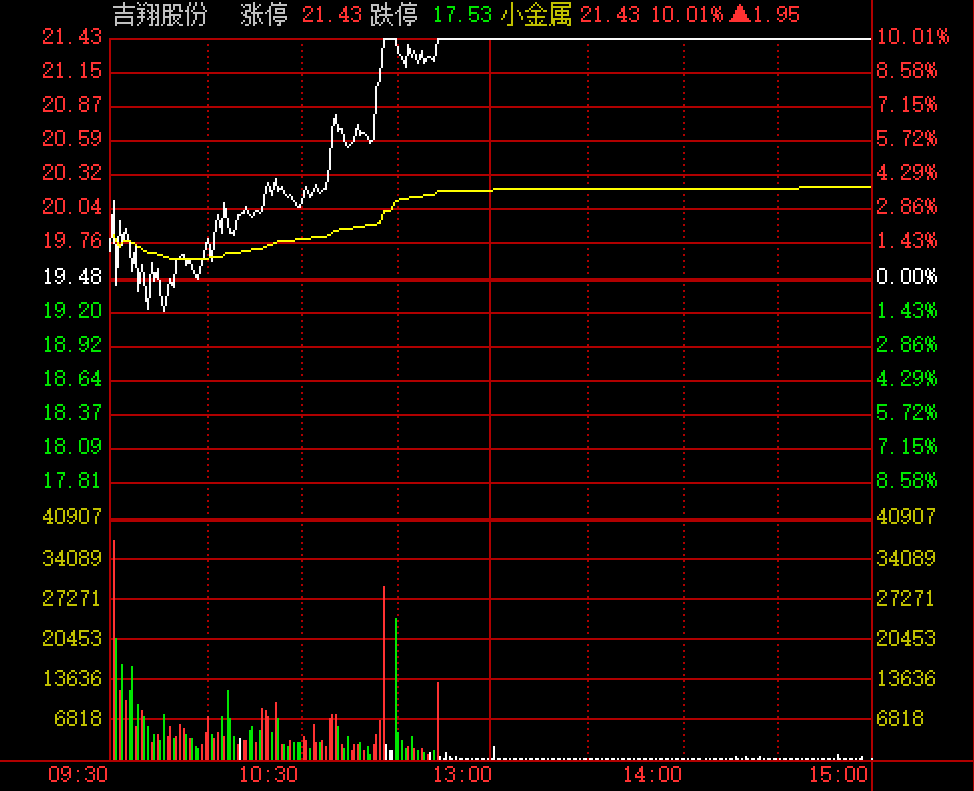

Great Wall Securities Sichuan Branch: it bought 125 million shares of Jixiang.

If Ningde rose sharply tomorrow, the plate may further accelerate.

They will be released free of charge every day.

If they cannot repair the overall situation or continue to fall, they still have to find a way out.

On the disk, the geographical concept of Russia and Ukraine is still active, and the oil, gas and ports in the risk aversion plate continue to rise.

This is mainly due to a series of advantages in the photovoltaic sector: 1) the installed capacity of photovoltaic in January exceeded the market expectation, with a total installed capacity of 7gw, a year-on-year increase of 200%, and the distributed installed capacity of 4.5gw, a year-on-year increase of 250%.

If the floating profit is relatively rich, it can consider t holding.

This stock is a trend stock with high popularity.

In terms of individual stocks, quasi oil shares and Renzhi shares continued to have three consecutive boards, Jinzhou port, Tianshun shares and Zhejiang Dongri were promoted to two consecutive boards, and PetroChina capital, Hailian Jinhui, Xin’an century and Sifang Jingchuang rose by the limit.

According to the statistics of the international energy network, the photovoltaic module procurement projects of central state-owned enterprises in 2021 were about 43gw.

On February 24, the average price of industrial grade lithium carbonate in East China was 439600 yuan / ton, an increase of 23.97% over the average price at the beginning of the month.

After sharing with you last week, I found that many iron powders have not paid attention.

The news is that it bought 100% equity of lithium company on January 6, which is a revaluation logic of undervalued lithium carbonate.

Please cherish it.

If the sentiment can be repaired as scheduled tomorrow, Then those with positions can sell when the opportunity to rush higher is given in the session.

After clicking the attention below, you can get an exclusive operation strategy.

Many mobile phone news and exclusive research reports will be collected every day.

The price of photovoltaic silicon material and silicon wafer has increased slightly in recent month, but the capacity has continued to increase from the installed capacity in January and the production data of the following two months.

You can’t afford to lose.

In February 2022, the price of lithium carbonate kept rising until the end of the month.

Recently, funds have been attacking the lithium resource sector.

On the plate, CIPS and digital RMB concepts rose sharply at the opening, the epidemic in Hong Kong continued to break out, the new crown prevention and control plate changed, the new crown detection and new crown drugs were locally active, and the lithium battery plate reversed.

Please pay attention to the big housework.

On the same day, institutional trends institutions net bought the top 3 yimicang 39.76 million (Digital Economy) Botuo biology 33.99 million (Xinguan detection) Yujing shares 16.18 million (photovoltaic) net capital bought the top 3 Three Gorges energy 365 million (green electricity) Zijin Mining 244 million (nonferrous metals) Ganfeng lithium 169 million (lithium mine) capital continued to flow into banglongji shares 1.552 billion (photovoltaic) and Northern rare earth 1.146 billion (rare earth) On the 10th, banglongji shares 2.576 billion (photovoltaic), Tianqi lithium 2.355 billion (lithium mine), northern rare earth 2.265 billion (rare earth), Ganfeng lithium 2.251 billion (lithium mine), Wuxi apptec 1.984 billion (Medicine), sunshine power 1.768 billion (energy storage), Tianci materials 1.248 billion (lithium battery), Weili energy 1.179 billion (lithium battery), Yongtai technology 1.118 billion (lithium battery) Baotou Steel shares 1.116 billion (steel) Hesheng silicon industry 1 billion 116 million (silicon material) north Huachang 1 billion 95 million (chip) elegant group 1 billion 90 million (lithium ore) BYD 1 billion 81 million (new energy vehicle) Huyou cobalt industry 1 billion 63 million (lithium battery) gold seed wine 1 billion 13 million (Baijiu) agency summary recently, the fund bought Longji shares 1 billion 552 million, the funds do so.

Don’t always ask me where to read the news and where to read the research report.

The production schedule of all links is close to full production, and it is expected to exceed the expectation in the first quarter.

Before writing the text, say something to everyone! Recently, a special public account has been set up in the circle of friends.

Large hot money such as popular lovers and Fang Xinxia have taken over recently.

In the long run, the global PV installed capacity is expected to exceed 200GW in 2022, with a year-on-year increase of more than 30%.