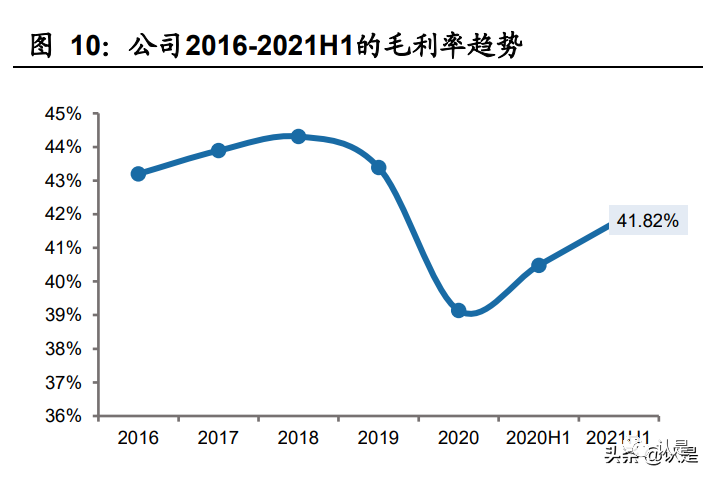

The company chooses fine operation, optimizes the supply chain, increases product discount and de inventory, so as to keep the inventory level at a healthy level.

In the same year, Tebu invited Hong Kong artist Nicholas Tse as the brand image spokesperson, creating a precedent for the marketing of sporting goods and entertainment.

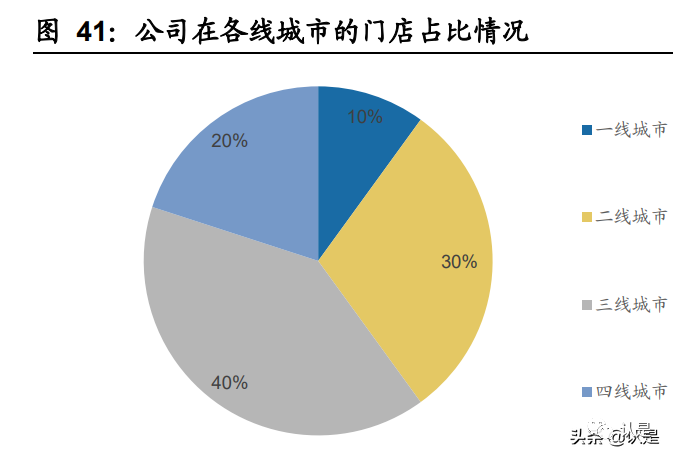

So far, the main brand Tebu has a huge distribution network of more than 6000 retail stores.

“Product +” means to strengthen the functional attributes of products, improve the scientific and technological content of shoes and clothing products, and expand the product line.

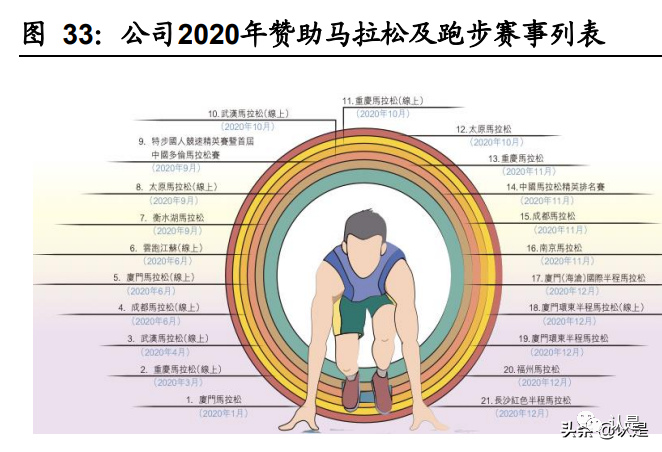

“Internet plus” is based on the retail and offline activities of big data for runners and consumers.

(report producer / Author: GF Securities, MI Hanjie) I.

In addition, the group has vigorously introduced outstanding talents as the core management.

At the same time, in the corporate governance structure, the traces of the original family management are further weakened, and high-quality talents are vigorously introduced.

Brand development period (2001-2008): in 2001, the “Tebu” brand was established, the business strategy focusing on export gradually changed to domestic sales, and began to explore and cultivate independent brands.

after 30 years of deep cultivation in the field of sports, the leading brand of domestic sports shoes and clothing (I) strategic change has become the main theme, the equity concentration of family enterprises is stable, and Tebu international is a leading sporting goods enterprise in China, The predecessor was “Fujian Sanxing sporting goods company” founded in 1987, which mainly engaged in OEM of overseas brand sports shoes and clothing.

Li Guanyi has served Adidas, Esprit and other companies and led Adidas north to increase the business volume from 700 million yuan to 3.3 billion yuan; Yuan Weidong, the new CEO of global business division, once served as vice president of noble bird.

Strategic transformation period (2015-2018): XTEP put forward the “3+” strategic transformation in the 15 years: Product + sports + Internet plus.

Through technology, a seamless retail system with user experience and community construction is established, and customized product advice and information services are provided according to runner data.

By the end of 2020, the board of directors of the group had granted a total of 25.05 million shares in the form of repurchase and free gift, and 9.12 million shares belonged to incentive objects in 2020.

The equity of family enterprises is clear and stable, and equity incentive radiates internal vitality.

Tebu international adopted the equity incentive plan in 2014 and established a trust fund as an employee stock ownership platform.

Among senior executives, professional managers account for more than 90%.

In 2001, it began to develop its own brand.

“Sports +” means that the special step brand changes from simple sports sponsorship to comprehensive services to build a running ecosystem.

Rapid expansion period (2009-2011): affected by the financial crisis, Tebu’s share price fell all the way.

Tebu international was successfully listed on the Hong Kong Stock Exchange in 2008.

Since 2005, special steps have been taken to promote restructuring and listing on a large scale, further clarify property rights and standardize tax behavior.

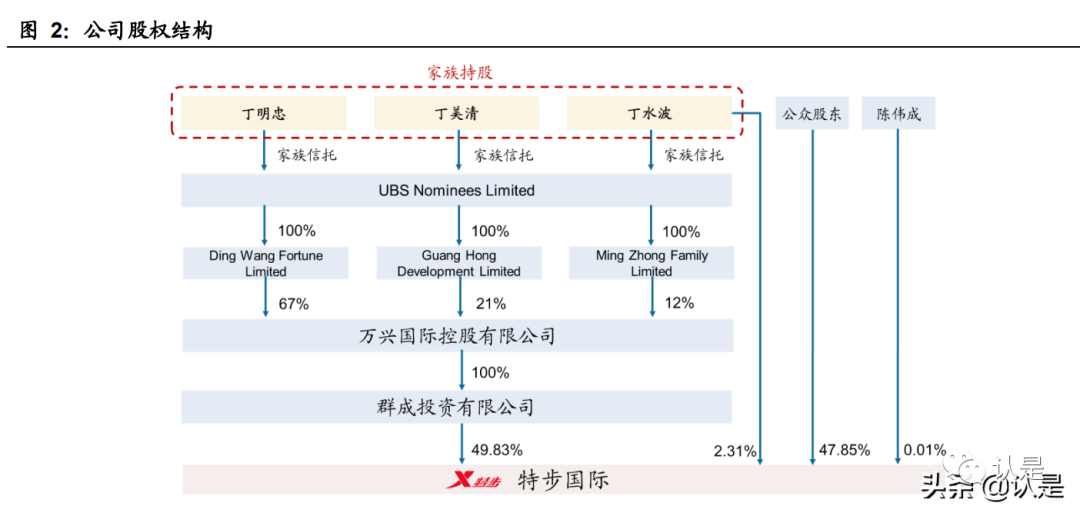

The ownership concentration of family enterprises is clear, which is conducive to the implementation of enterprise strategy.

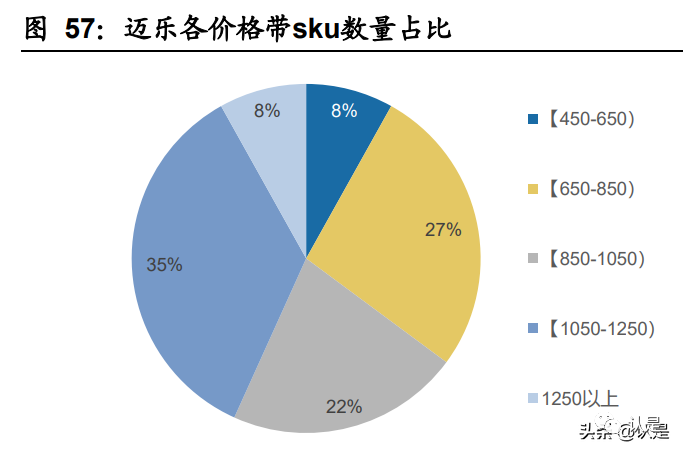

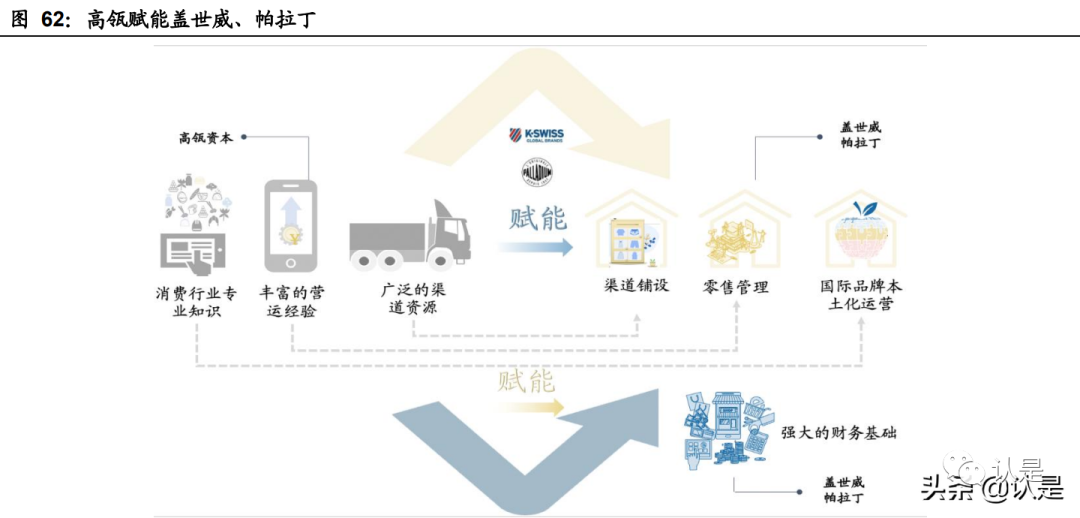

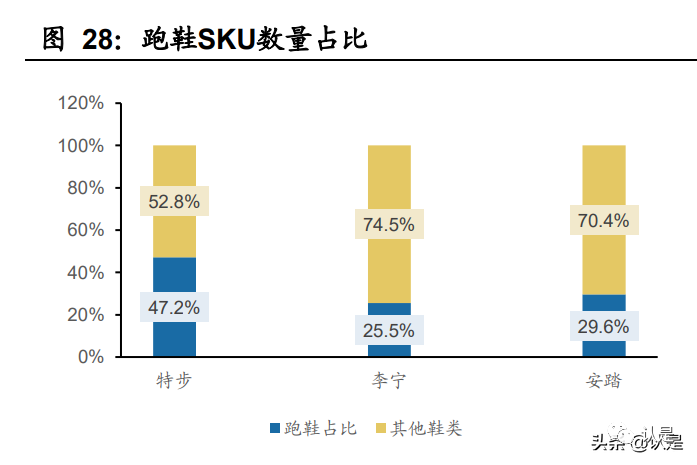

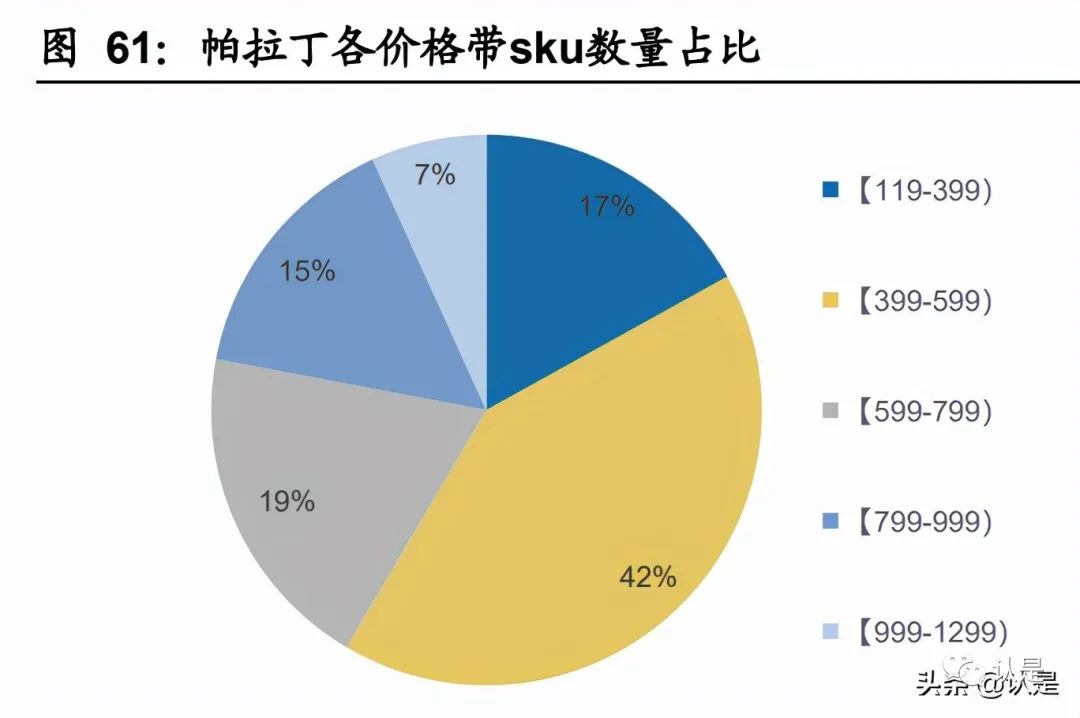

Multi brand development period (2019 to now): the company established a joint venture with Wolverine in March 2019 to be responsible for the operation of shoes, clothing and accessories under sokoni and Maile brands, and acquired gasway and paladin in August 2019, officially opening the multi brand and international strategy, forming a mass sports plate with special step as the core The brand matrix of professional sports sector with soconnie and Melo as the core and fashion sports sector with geschweier and Paladin as the core.

Tebu international binds the core employees with the interests of the group through the employee stock ownership plan and equity incentive plan, which is conducive to stimulating the vitality of the enterprise.

The company added indoor comprehensive training, outdoor and yoga and other categories in 2016.

Yang Lubin once served as the senior financial manager of Dacheng food (Asia); In 2014, Tebu international hired Li Guanyi as the CEO of Tebu’s main brand business department.

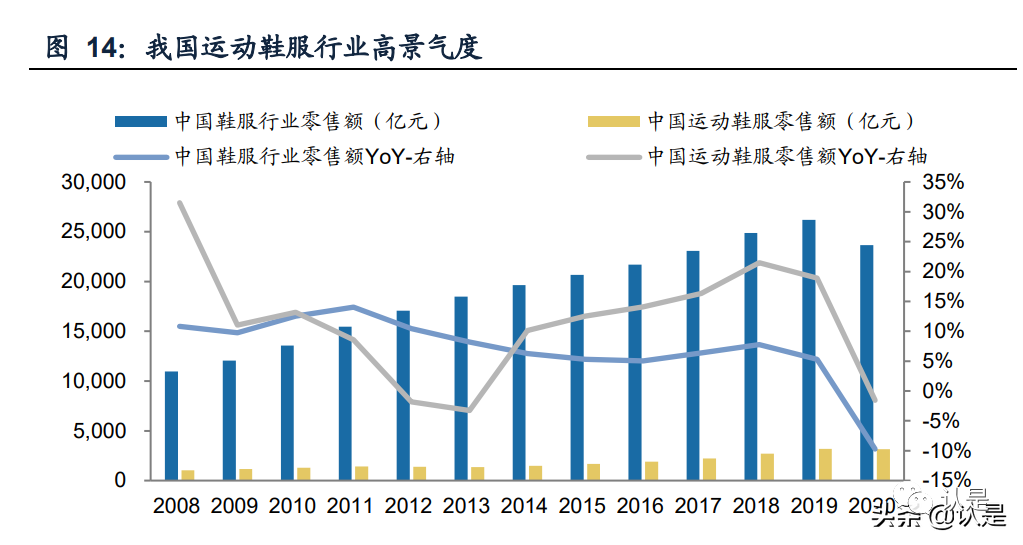

Adjustment and exploration period (2012-2014): China’s sporting goods industry has entered a trough due to extensive operation, brutal expansion, channel inventory backlog and other factors.

Ding Mingzhong is responsible for the accessories business of the group.

Tebu international is a family business.

to jointly develop the global business of gasway and paladin brands with the company and help the company’s multi brand and internationalization strategy.

In 2021, Hillhouse capital invested in Tebu Global Investment Co., Ltd.

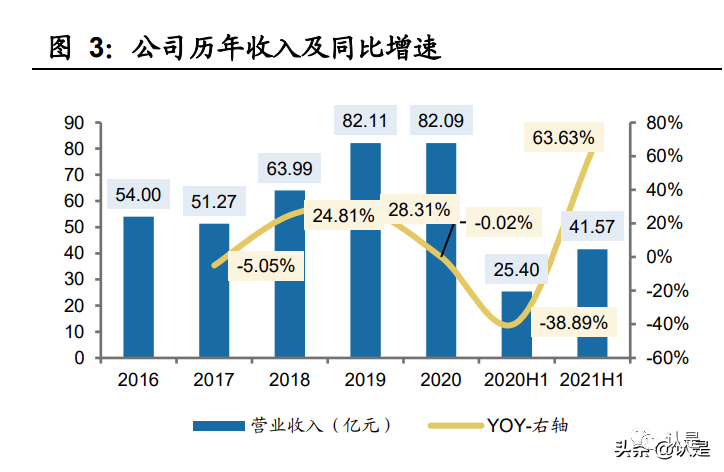

In 2008, the revenue / net profit of Tebu international increased by 110% / 129% year-on-year respectively, and the revenue also maintained a year-on-year growth of 20 +% in the following three years.

Through the historical development of FuPan Tebu since its establishment in 2001, it can be roughly divided into the following five stages: brand development period, rapid expansion period, adjustment and exploration period, strategic transformation period and multi brand development period.

In addition, Ding Shuibo directly holds 2.31% of Tebu international and is the actual controller of the group.

In the Ding family, Ding Shuibo is responsible for the overall corporate strategy, planning and business development of the group; Ding Meiqing is responsible for the group’s product design and development and supply chain business, focusing on consolidating the position and reputation of shoes in the industry.

Tebu has been continuously excavating excellent talents at the core management level and has rich experience to inject fresh blood into the development of the group..

In 2019, it developed international top brands such as sokoni, Maile, Paladin and gasway by means of acquisition and establishment of joint ventures, opened a multi brand and international strategy, and formed a mass sports plate with Tebu as the core The brand matrix of professional sports sector with soconnie and Melo as the core and fashion sports sector with geschweier and Paladin as the core.

As of June 30, 2021, according to the company’s financial report, the founders Ding Shuibo, Ding Meiqing and Ding Mingzhong (three brothers and sisters) indirectly hold 49.83% of the shares of Tebu international through UBS family trust.

However, affected by the upsurge of national sports triggered by the 2008 Olympic Games, the sports industry expanded rapidly into stores and its performance increased rapidly.