This figure is down from 140.845 billion yuan in 2019, but considering the current venture capital environment, the performance of enterprise service track is quite good

.

After the frenzy in 2020, the oligarchy effect is even more obvious

.

1

.

On the other hand, if cloud manufacturers and data service providers completed the initial digital education in the market a few years ago, this year, the veil between business and digitalization will be completely torn off – in order to continue to live, online and rapid digital transformation is the only way out, which makes enterprises embrace many technological trends that they had no time to take into account before, such as cloud computing and mobile computing The market demand such as information industry is booming, “allin online” has become the theme of 2020

.

All of these make this year’s enterprise service track still maintain its popularity in recent years and become one of the most concerned tracks in the venture capital circle

.

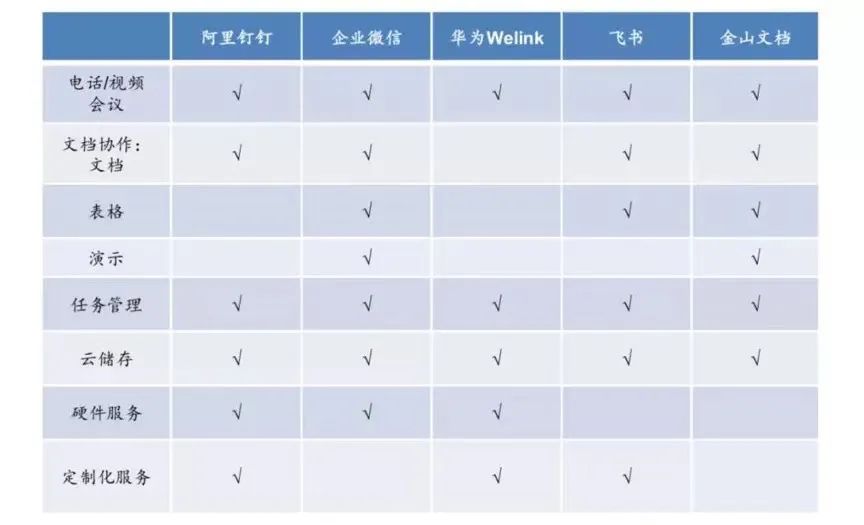

With their products nailing, enterprise wechat, flybook and so on, the giants have made rapid layout

.

But compared with the mobile Internet and other fields, China’s enterprise service is still a track that has not been settled

.

Data source: Jingzhun is specific to the segment track

.

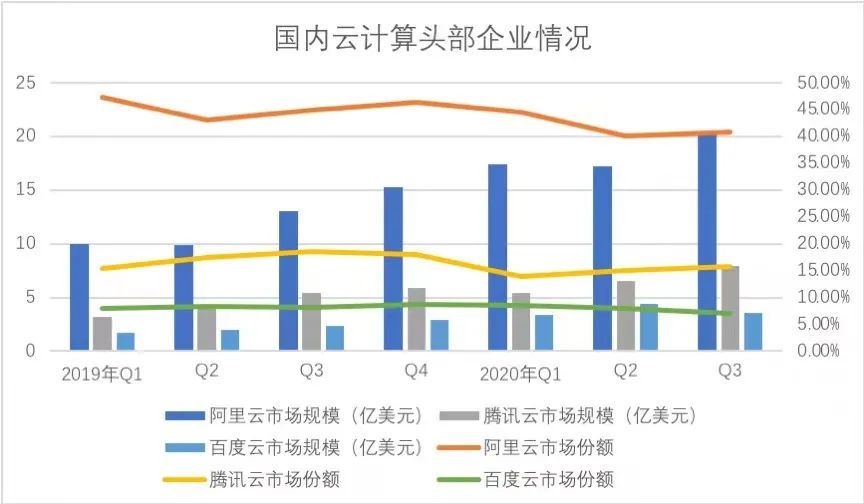

The IAAs market grew by 57.1% and the PAAS market grew by 64.4%

.

The new economic format in the first quarter was obviously under pressure, and the track was shrouded in a more pessimistic mood

.

In addition to the giants, the enterprise service start-ups show their own skills in the vertical track, and the first batch of enterprise service start-ups gradually move towards the secondary market stage

.

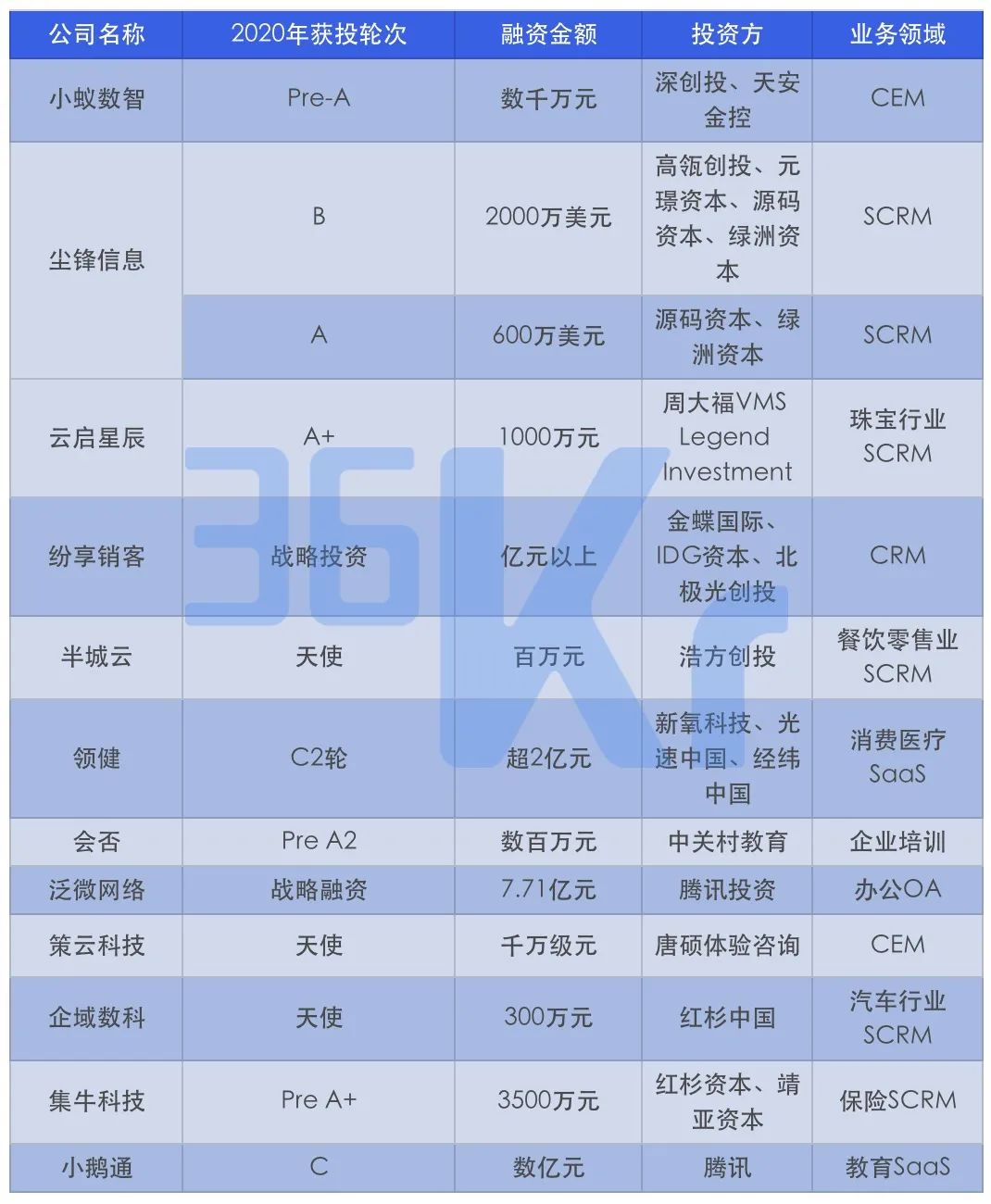

In terms of financing rounds, the continuation of enterprise service track financing has been concentrating on later projects since 2016, and many tracks have seen multiple mergers and acquisitions and strategic financing

.

On the other hand, affected by the macro environment and the cold winter of capital market, the number of projects before round B is further reduced

.

However, opportunities will still be left to those who are constantly seeking major breakthroughs

.

This also further reflects: after the development of the previous few years, each vertical track has appeared more than the growth period of the company, enterprise service track business is becoming mature

.

Only when the international situation is not clear, can they meet the difficulties and take over customers from foreign manufacturers

.

After the epidemic slowed down, the enterprise service track also ushered in the opportunity of rapid development

.

From the beginning of the epidemic to this year, after a whole year of rapid iteration and development, the entrance and ecological war of Tob ecology have begun to emerge

.

In the private cloud market, the competition pressure of small and medium-sized enterprises is increasing

.

Alibaba cloud, Tencent cloud, Huawei cloud, China Telecom Tianyi cloud and AWS, the total market share of the five public cloud manufacturers reached 76.7%

.

At the beginning of the year, the macroeconomic environment was unpredictable, and the epidemic situation and domestic substitution became the biggest variables of enterprise service

.

The “telecommuting experiment” of the whole society has lasted for a whole year, bringing huge demand for cloud video, cloud office and cloud conference

.

According to Jingzhun data, cloud services, data services, Collaborative Office & communication, CRM & marketing, and enterprise security are the investment hotspots of enterprise services this year

.

Another reshuffle period of the enterprise service track has begun slowly

.

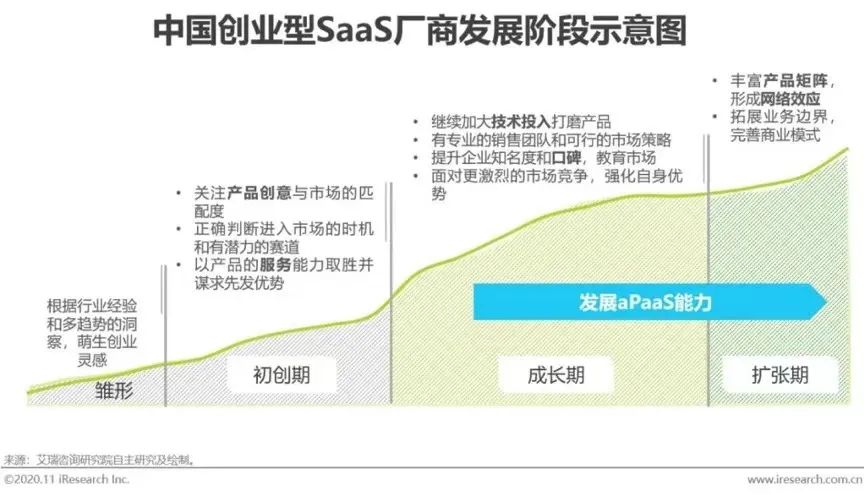

For a long time in the past, many SaaS companies invested by Jingwei had revenues of tens of millions

.

Xiong Fei, partner of Jingwei China, told 36 krypton that in 2020, China’s enterprise service entrepreneurship has gradually become mature from the wilderness, many companies have come out, and the model has been verified

.

Products are gradually landing, and they have the ability to serve big customers

.

In addition, other manufacturers actively seek change or withdraw from competition, such as Baidu Intelligent Cloud in 2020 experienced a major structural adjustment, Jingdong cloud, Jingdong artificial intelligence, Jingdong union of three brands were integrated as “Jingdong Zhi Lian Yun”; and the United States Mission cloud, Su Ningyun closed public cloud business in 2020

.

In addition, the expansion of giant business has also accelerated industry investment and M & A

.

The giants have also launched a battle of Tob

.

For start-ups, a lot of vertical tracks have been occupied by head companies

.

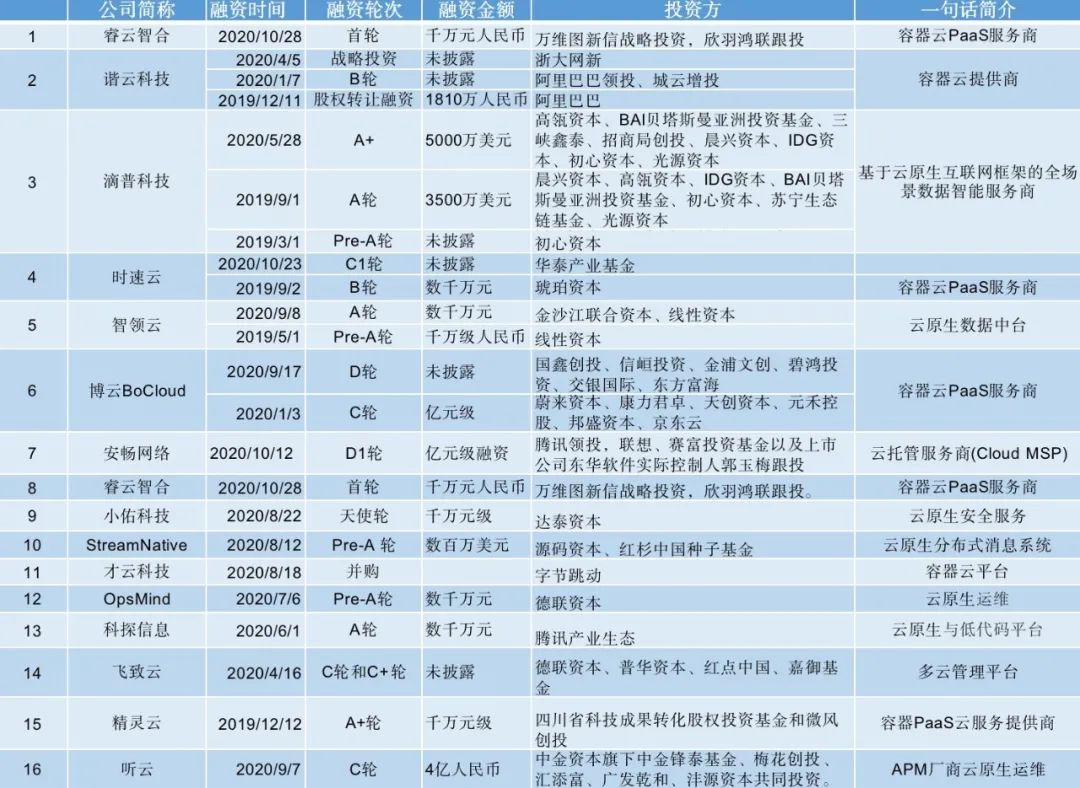

The cloud service track will shine in 2020, laying the foundation for the smooth progress of digitization and online

.

Cloud computing track has become the capital focus

.

The public cloud has long been a giant’s playground

.

Growth is still the top priority

.

Giants run into the market, start-ups compete cruelly, sink into the market or spring? Looking back ten years from icphoto, 2020 will also be a milestone year for the track: the epidemic situation makes all enterprises fully aware of the necessity of digitalization and online, and the enterprise service track is advancing at multiple speeds; the giants have stepped into the market, and the first batch of enterprise service companies have reached the mature stage and even the listing stage, and they have become the same as the giants In addition, there are also new stars who seize different customer groups and sprout quietly in the sinking market to become the next generation of unicorns

.

In the face of giants entering, running and expanding boundaries, how to act, or even whether to continue to act alone, has become an unavoidable problem for the head start-ups; the problem for the waist and budding companies is how to ensure growth and considerable revenue in turbulent years? How to get the favor of capital and market by cutting the demand in the red eye track? In general, the story of enterprise service track is still developing steadily

.

On the one hand, many business owners fell into business difficulties or even went bankrupt, and many industries entered the most difficult quarter in history

.

According to Jingzhun data, as of December 31, 2020, the number of financing events of enterprise service track is about 1202 (including the financing of listed companies and new third board companies), and the total transaction amount is about 136.27 billion yuan

.

Cloud origin is also the natural development result of the initial establishment of cloud ecology Fruit

.

Foreword the enterprise service track in 2020, half sea water, half flame

.

According to the report “China’s public cloud service market (first half of 2020) tracking” released by IDC, in the first half of 2020, the overall market size of China’s public cloud service (IAAs / PAAS / SaaS) reached US $8.4 billion, a year-on-year increase of 51%

.

When the cloud technology gradually enters the deep water area, “cloud native” has become the investment theme of 2020

.

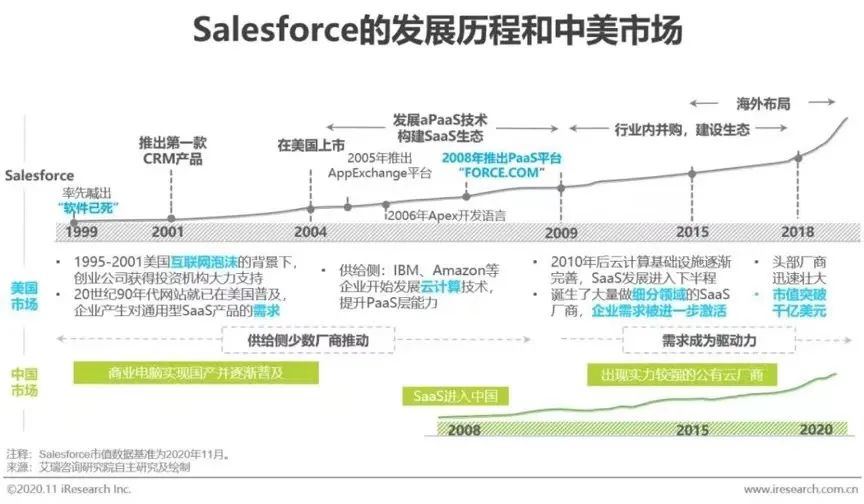

The logic of domestic substitution is also similar – this year, CRM and database manufacturers have gone through the exploration period of product and customer positioning in previous years

.

Epidemic situation and international trend can only be catalysts

.

Without the accumulation of products in tob field in the past few years, Chinese manufacturers can not undertake this sudden opportunity: the accumulation of cloud computing track in the first decade has initially completed cloud computing, so that collaborative office manufacturers can take advantage of the tuyere of remote office this year to develop rapidly

.

Many investors pay more and more attention to hard indicators such as product landing and income

.

Of course, the track providing services around this group can not be spared

.

Cloud service: with the initial end of cloud, the original cloud has sprung up

.

Head and star start-ups are favored by capital, Matthew effect intensifies, and the pressure on waist and budding companies is further strengthened

.

In addition, the maturity of Chinese enterprises’ service market is positively related to the income of Companies in the market

.

In 2020, the primary market is still struggling in the capital winter

.

Enterprise service track 2020, what is the most popular? 36 krypton combed the investment and financing trend of enterprise service track in 2020

.

in July 2020, byte completed the acquisition of container service provider “Caiyun technology”, which has become an important part of zitiao enterprise intelligent technology platform “volcano engine”; in 2020, Ali also led the investment of container cloud manufacturer “Xieyun technology”, and followed up the C company of public cloud manufacturer “Zhuyun technology” Second round financing.

.

Now, there are more and more companies with more than 100 million revenue, and still maintain a high growth rate of 50-100%

.