At the beginning of the new year, many funds were sold on the same day

.

In the days when “occupy Wall Street” was staged in American “leek” on the other side of the ocean, the hot topic of “fund circle rice circle” hung here for two days

.

He managed a fund that had soared up Baijiu and its net worth rose 5%

.

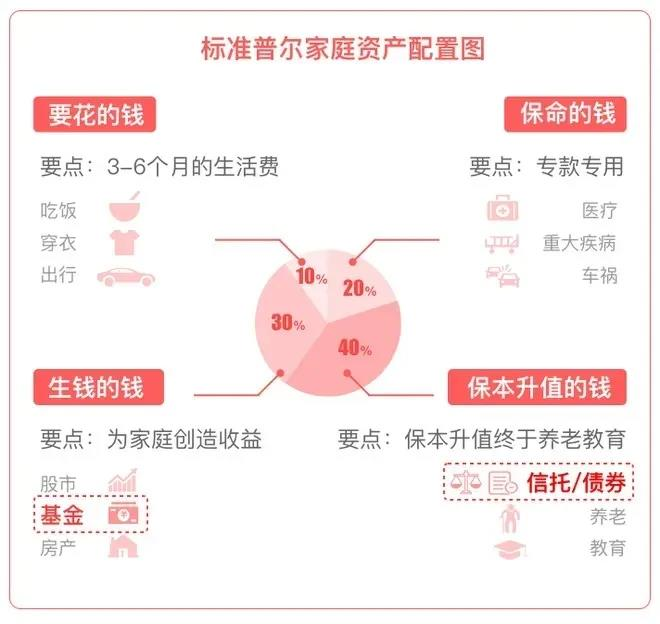

“Standard & Poor’s family assets quadrant chart” divides family assets into four accounts

.

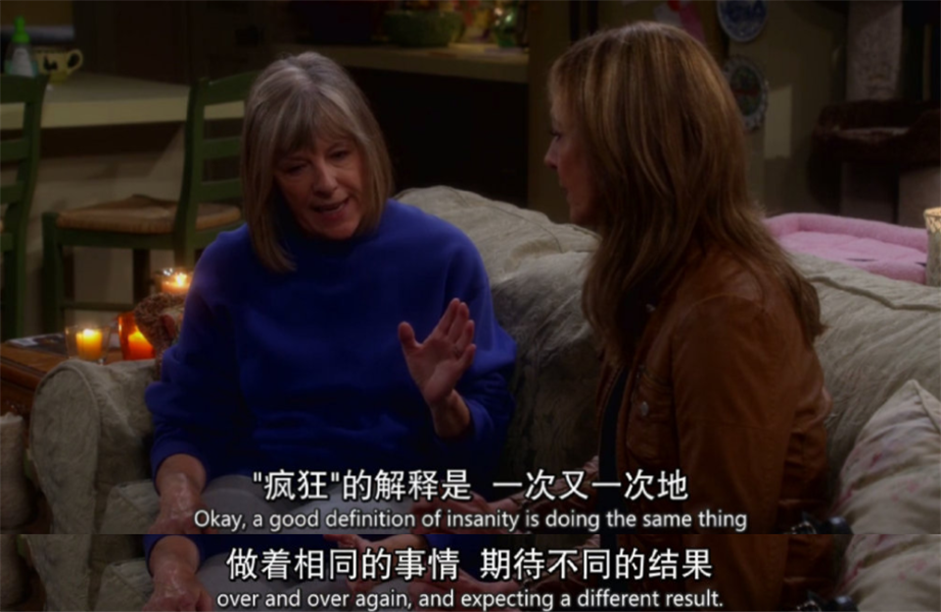

There is a saying in the investment circle that we are familiar with, which is called “eggs should not be put in one basket”

.

If young people don’t cooperate a little more, won’t they lose face? Of course, cooperation is enough – it is pointed out in an article that China’s financial market has not seen such a brave youth for a long time

.

On the contrary, eggs should not be put in the same basket at the scene of house hunting

.

The yields of yu’ebao and wechat change are going from bad to worse, and they are not enough to plug their teeth every day; the number of wealth management products sold by banks and their expected yields are also shrinking

.

If the risk tolerance is low, the proportion of the fourth account will be increased

.

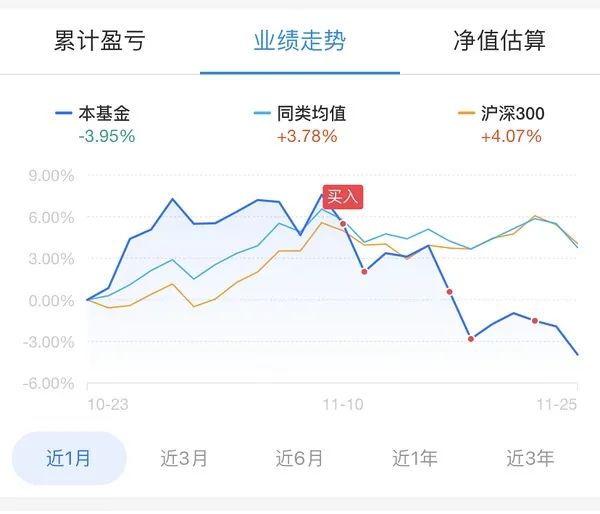

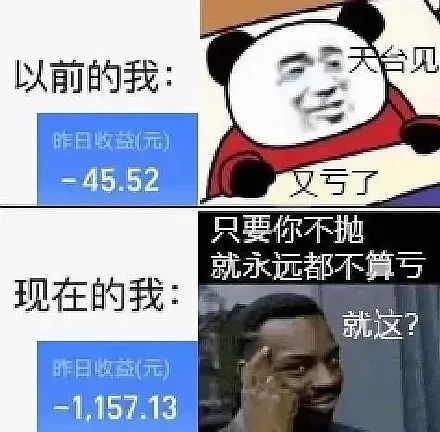

In the past, when people played with funds, they always wanted to run when they were nervous

.

Lock in profit: the so-called lock-in interest rate refers to that the insurance product has a predetermined interest rate, which is long-term, lifelong and fixed in the form of contract

.

If there was no accident, they would open their accounts and count money in a few years

.

Generally speaking, the proportion of the first and second accounts is relatively fixed, and the third and fourth accounts are adjusted according to individual risks

.

Insurance is mandatory, safe and long-term

.

But since the beginning of 2021, the atmosphere has been set off here

.

But I heard that the fund is to give money to professional people to invest, and I feel that I can still save myself

.

You can still buy 500000 insurance for 10000 yuan today, which is basically equal to the cost of treatment in the next 20 years

.

It’s similar to the principle of the law of “poor students have more stationery” in school

.

At that moment, he was not interested in fund investment

.

This is the advantage of insurance

.

They wanted to run when they went up, and they wanted to run when they went down

.

“The best Kun in the world is not Cai Xukun, but Zhang Kun.” “The best spring in the world is not Li Yuchun, but Liu Yanchun.” “What kind of Bo Jun and Xiao? We Zhou Yingbo and Xiao Nan’s” Bo Jun and Xiao “are the most important.” Unexpectedly, it’s today that witnessed the transformation of the Internet’s top stream

.

Insurance is to solve sudden large expenditure with small and broad scale

.

You see, the script has been written here step by step

.

It will not be affected by the external market and will not change because of the lower interest rate

.

It can be said that the security is no different from that of national debt

.

Super security: all principal and income will be determined in the form of contract

.

It means reducing risk by diversifying investment

.

Who was attracted to rush in? According to the data of CCTV finance and economics, more than half of the “new fundamentalists” were born in the 1990s

.

It is the best financial tool for family finance! When the crisis comes, you are ready to ride out the storm.

.

The most appropriate posture was to pretend that it didn’t exist after they bought it

.

Therefore, in terms of the allocation of these four accounts, insurance is the safest and most stable account, and it is also an indispensable financial tool for families to avoid risks

.

We don’t need to waste brain cells to study financial management knowledge after busy work

.

Suddenly, he had a wonderful empathy with the old people who were left behind by the times – “every day he was talking about running into the market to buy funds, but you are young It’s too fast for people to run Before, you rarely saw fund manager, a career with “deep merit and reputation”, so popular by Internet public opinion

.

This product can not only achieve the purpose of saving and increasing value, but also flexibly provide cash flow to meet unexpected needs, supplement pension, and even pass on to future generations

.

A more suitable diversification should be to spread money to different kinds of financial products with different risk levels

.

If you understand this sentence, you will understand that insurance is forever wealth

.

These four accounts have different functions, so the investment channels of funds are also different

.

Eggs should never be put in the same basket

.

In fact, this is not surprising, after all, today’s mainstream young netizens are used to this way of expression, where they go, where they go

.

Leverage principle: an epidemic situation puts great pressure on our wallets

.

In addition to last year’s unprecedented breakthrough of 3 trillion in the issuance volume of China’s public funds, the biggest focus of a paper issued by the CSRC at the end of the year was immediately captured: promoting the transformation of residents’ savings into investment

.

By the 26th, 94 new funds had been established, raising more than 400 billion incremental funds and setting a new record

.

Easy to realize: according to the regulations of the CIRC, insurance has the function of policy loan, and can loan up to 80% of the cash value of the policy, which can alleviate the awkward situation of poor capital turnover

.

Once you do it, you will rebuild a stock market for yourself

.

Now it’s a good thing, “if you increase your position, if you increase your position, you will be able to grow stronger.” if you don’t double your income, you will be able to survive until the end of time

.

If the risk tolerance is high, the proportion of the third account will be increased

.

But when my post-80s colleague found that his nephew, who was just a freshman, had sent such a message, he began to be confused: “I had known to make up more positions

.

Even people with more conservative ideas can hardly escape the huge waves under their feet

.

For those who have just entered the society, what is the relationship between the property market and those who can’t earn a toilet a year? Stocks are too complicated

.

The key is that the same money can buy today’s insurance after 20 years? Do you still think insurance can’t beat inflation? The advantages of insurance, Hong Kong’s savings insurance, just to meet the financial needs of many friends

.

Most importantly, the threshold is also low to almost no word of mouth

.

This sentence is a simple and popular interpretation of the principle of asset allocation, and has become an investment criterion known to all ages

.

If you don’t do it, you will have to do it

.

This was put forward by James Tobin, the winner of the Nobel Prize in economics in 1981

.

The endorsement of this contract is the insurance law, the contract law and the insurance supervision of the whole country

.

During the loan period, the interests of the insurance policy are still valid and the funds are flexibly revitalized

.

The foundation has become the direction of the adjustment of the wealth structure of Chinese residents, which has already appeared

.

The first enviable return money was also more violent than Israel’s

.

But for most people who are not familiar with financial products and have not much investment experience

.

See the circle of friends sun out that the money earned by the fund one day is higher than the salary of one month, can someone really do it without any waves in their heart? In contrast, it has become more and more difficult to earn extra money in the past year

.

It is a predetermined interest rate return that lasts for a lifetime

.

In addition to the recent hot search of “funds”, some people always say that “now the post-90s meet to talk about funds”, and even the usual little sister group chat also began to talk about military new energy

.

At least, it can play a role of protection

.

It’s said that young people who can’t put eggs in one basket begin to understand the way to spread risks

.

From ticket grabbing, shoe grabbing to fund grabbing, the post-90s have finally grown into a generation of cutting (meat) to chant their aspirations

.

Recently, medicine has really soared up ~”

.

After all, investors who have really reached a certain level and scale will not yell on the Internet with their loudspeakers and perform repeated horizontal jumps between pink and black to fund managers

.

What’s more, no one can guarantee that you will not get sick until 20 years later

.

Yi Fangda’s Zhang Kun was suddenly pushed to the front desk, largely because of a low day in the market

.

Recently, the men regarded by thousands of young girls as the treasure of their hearts are a group of fund managers who have lost their hair but won the world

.

To recommend a more common tool – Standard & Poor’s family assets quadrant chart

.

In fact, this is just the concept of diversification, which is part of asset allocation

.