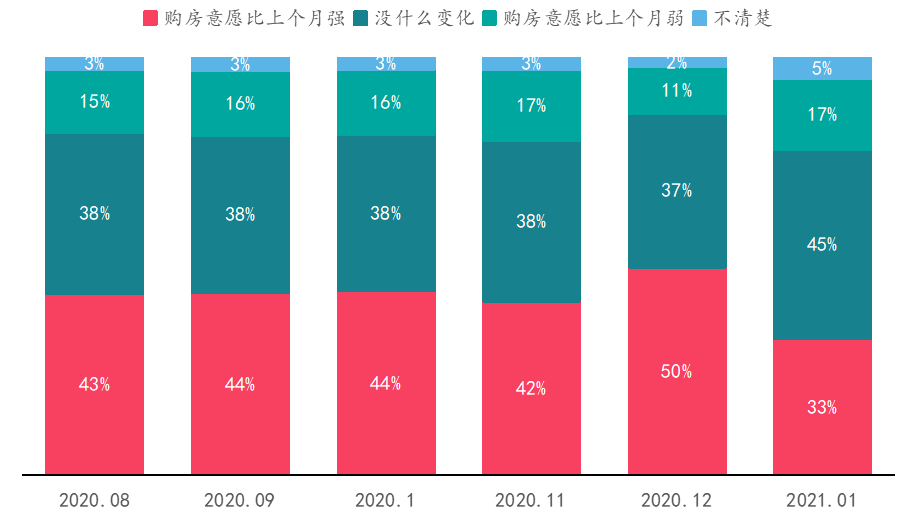

⑤ Decline in willingness to buy: after the release of demand at the end of the year, respondents’ willingness to buy houses dropped to the lowest point in nearly half a year in January

.

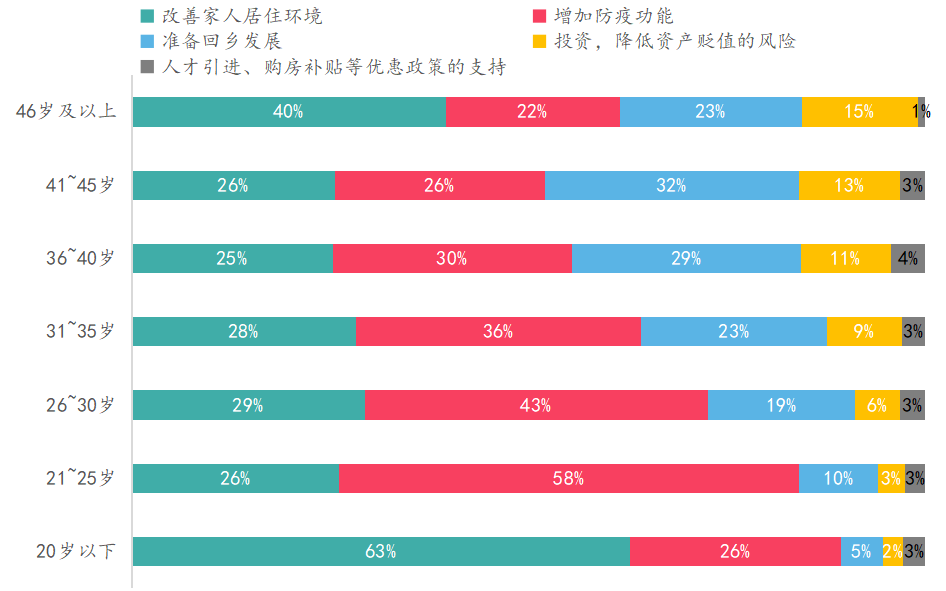

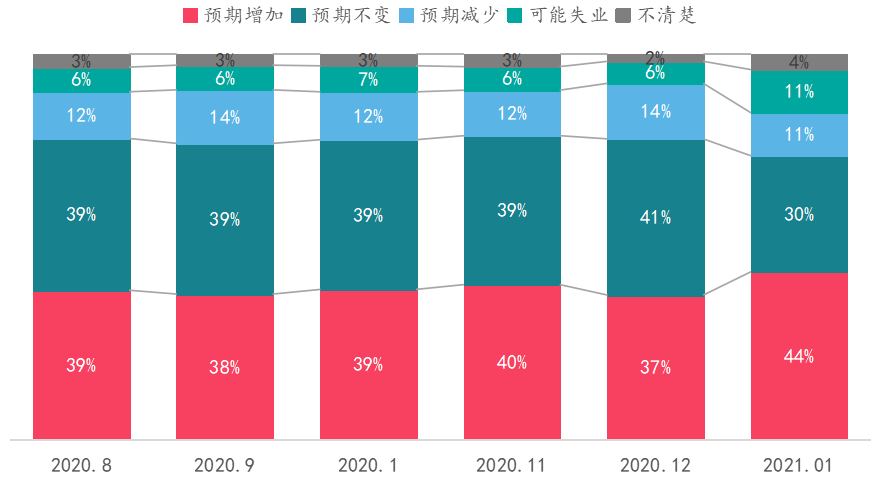

Compared with last month, this month’s respondents’ expectations of future income will increase significantly, and 44% of respondents expect that their income will increase in 2021, which is 7% higher than last month At the same time, the proportion of income reduction is expected to drop to 11% in 2021, but about 11% of the respondents said that there may be the risk of unemployment in the future, which has reached a phased high

.

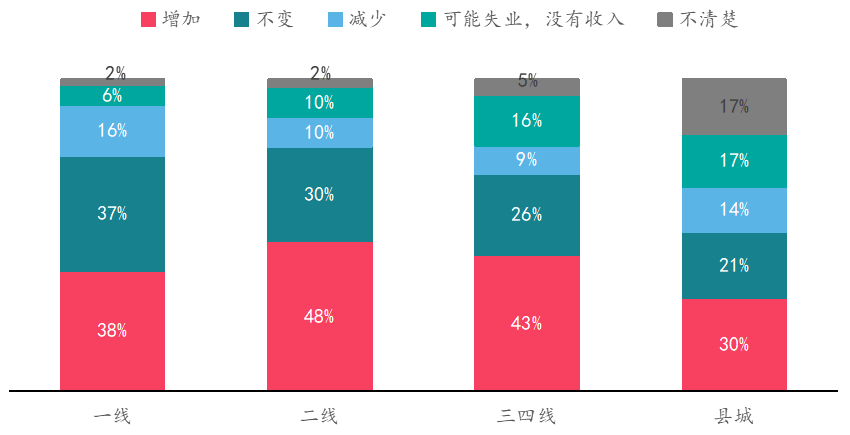

The proportion of respondents whose willingness to buy houses was stronger than last month dropped to 33%, while the proportion of respondents whose willingness to buy houses was weaker than last month increased to 17%

.

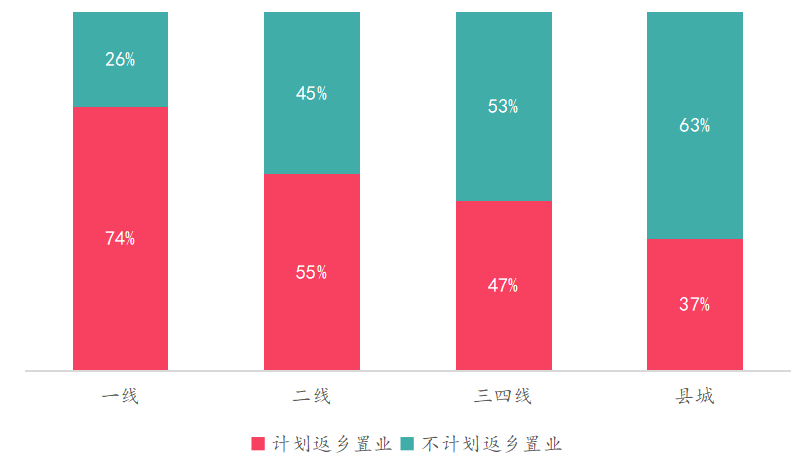

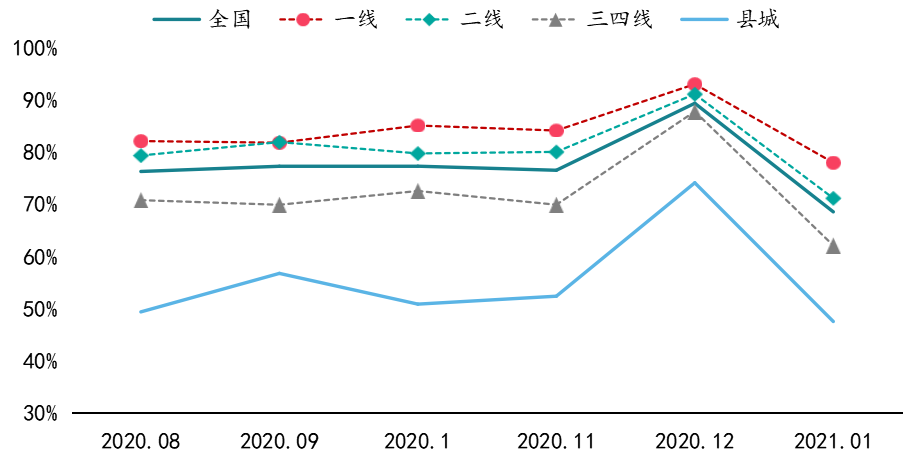

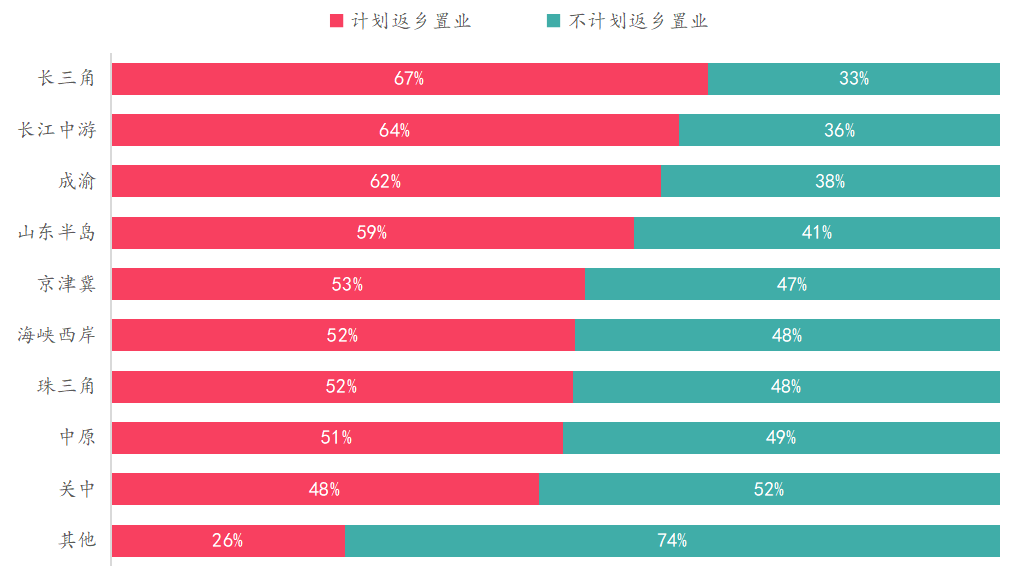

Figure: the proportion of respondents who have plans to buy houses from August 2020 to January 2021 (national and sub level) figure: the proportion of respondents who have plans to buy houses from August 2020 to January 2021 (sub region) 2

.

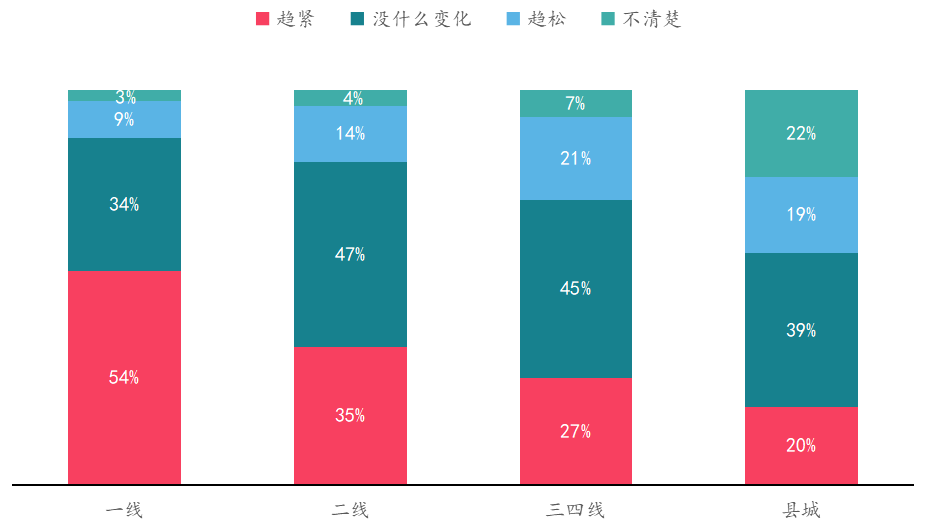

The recent monetary environment shows signs of tightening, and the lending speed and housing loan interest rate show marginal tightening, which makes the purchase node of planned buyers appear ahead of time

.

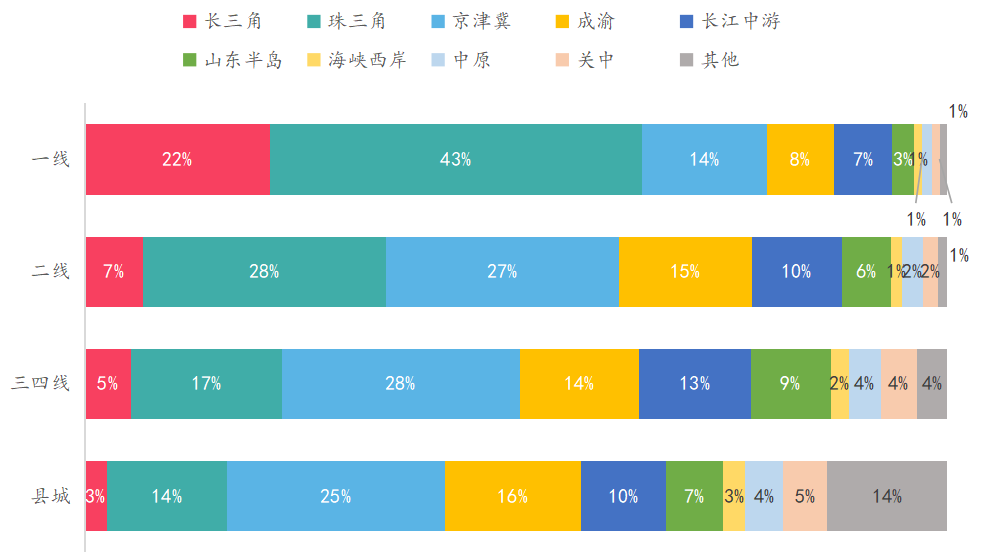

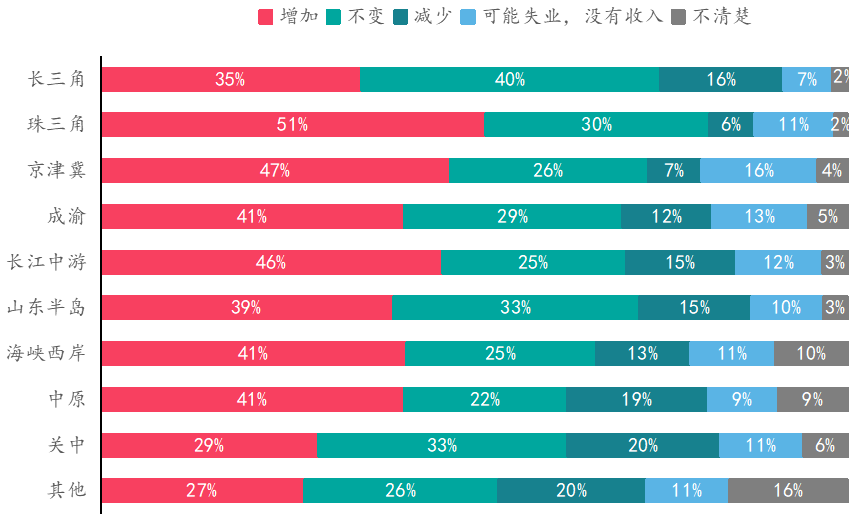

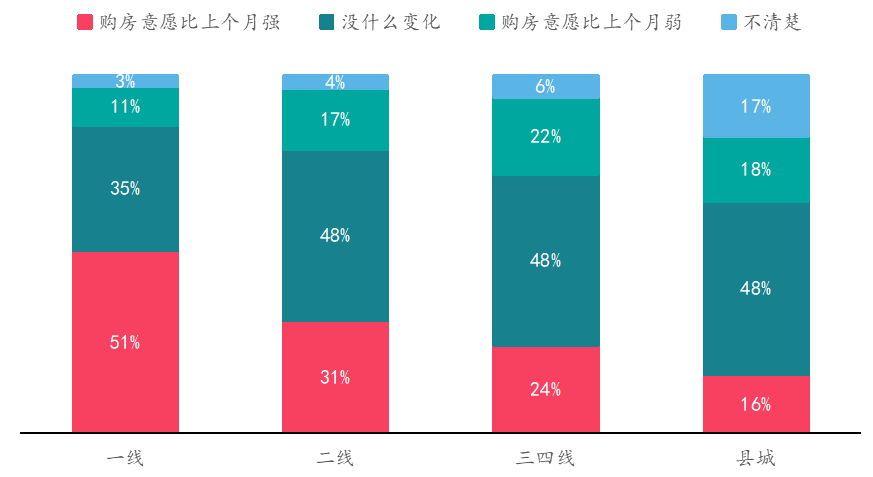

There is no problem in the future: respondents in the first and second tier cities are optimistic about their future income expectations, and they expect that their income will remain unchanged or increase by more than 70%

.

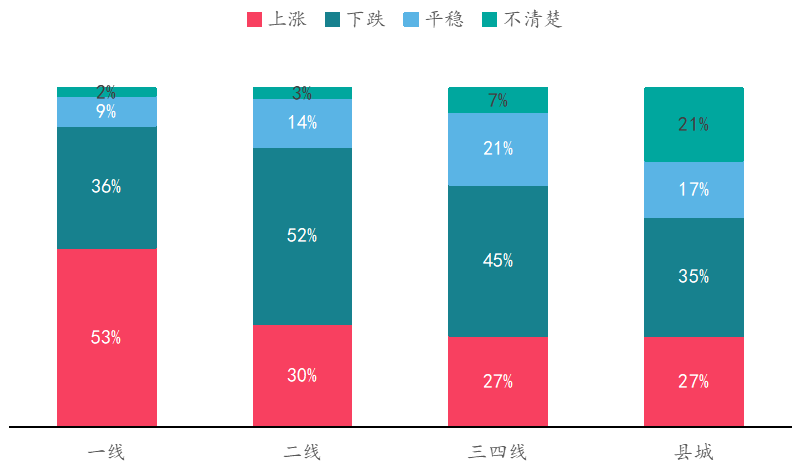

Compared with the previous three and four tier cities and counties, the respondents’ expectations for the future housing prices will rise in varying degrees

.

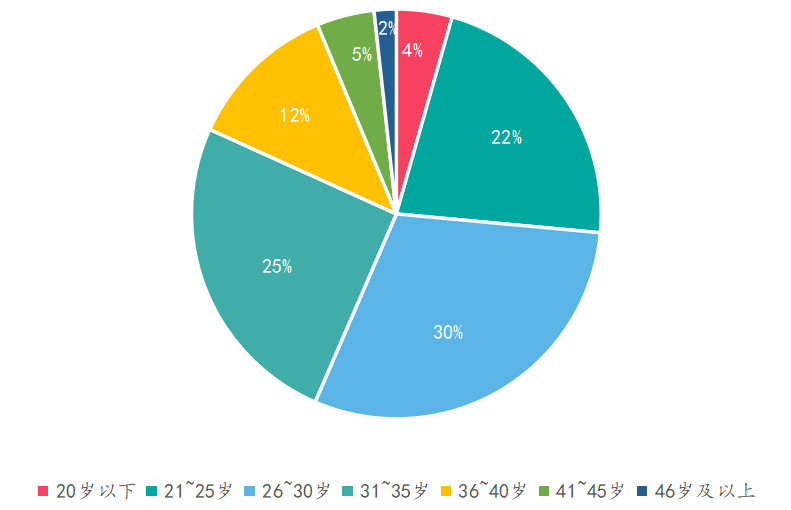

Judging from the energy level and age of the cities, most of the interviewees are young people working in higher level cities, who are the main force of house purchase demand

.

In order to continuously reflect the real estate mentality of Chinese residents, the survey continued to carry out a survey on the real estate willingness of urban residents across the country at the end of each month, and formed an analysis report based on the survey data, so as to dynamically understand the residents’ real estate confidence, real estate plans, policies and price expectations under the latest situation

.

③ Optimistic about the future income: 44% of respondents expect that their income will increase in the next year, 7 percentage points higher than that of last month

.

The future is not very good: respondents in the county towns Faced with more uncertainty, they are pessimistic about their future income expectations

.

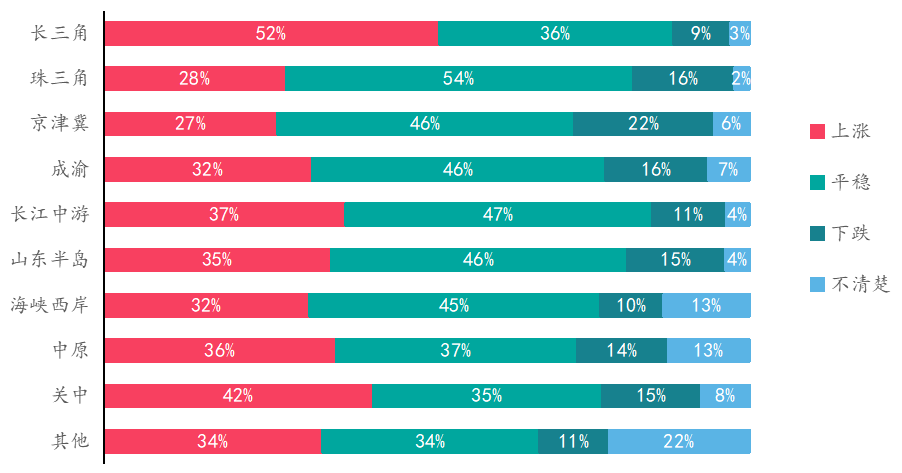

Figure: Respondents’ expectations of housing price changes in the next half year in January 2021 (different energy levels) ➤ different regions: the Yangtze River Delta is expected to rise significantly, and the proportion of Beijing Tianjin Hebei is the lowest

.

A total of 10000 questionnaires were collected

.

The epidemic situation reappeared, and the short-term house purchase plans were obviously shelved

.

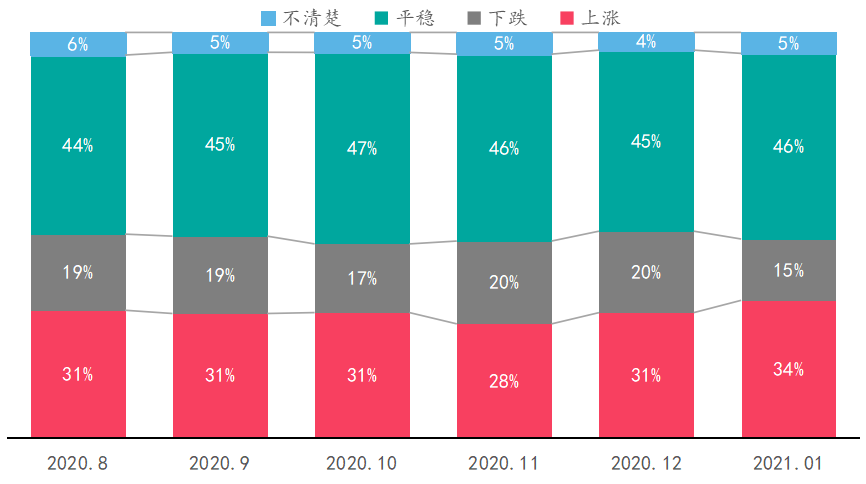

② House price is expected to rise: the proportion of expected house price rise this month continues to rise to 34%

.

Since the second half of 2020, many urban markets are heating up rapidly, and buyers are optimistic about the future

.

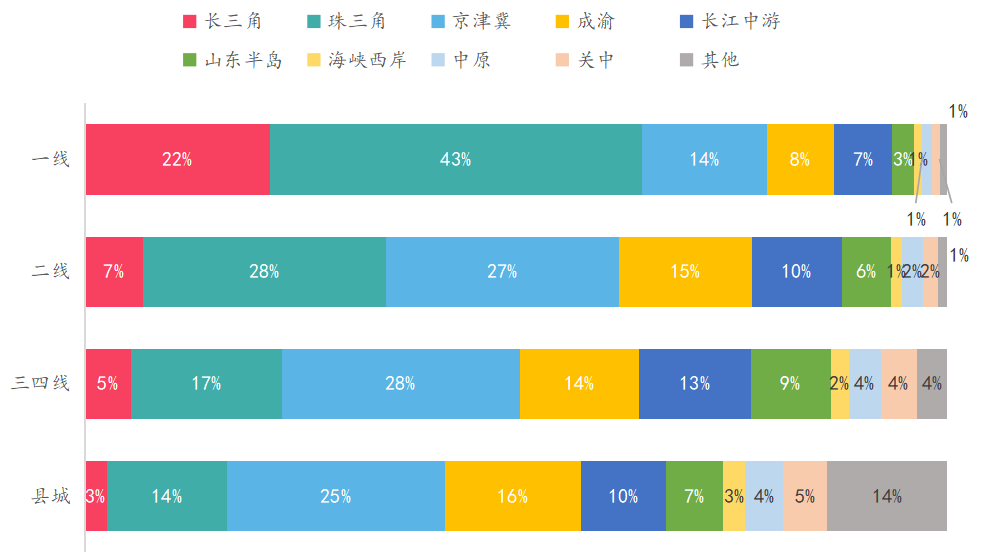

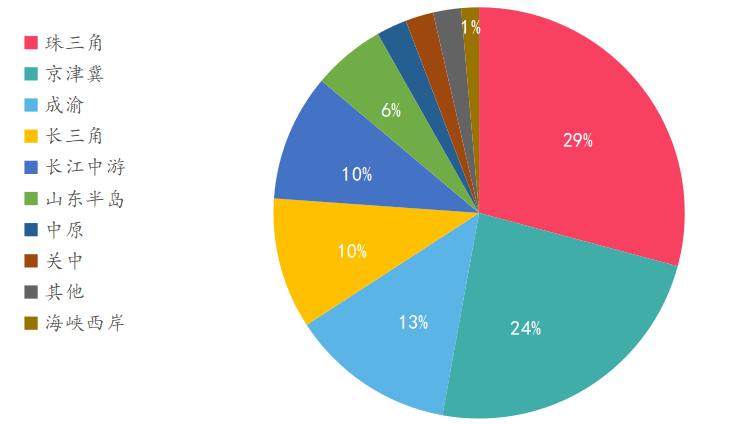

Judging from the regional distribution, most of the interviewees contribute to the National Urban Agglomerations with burst of economic vitality, because the real estate market in these areas is developed

.

Some weak second tier cities have obvious price for volume characteristics, and the short-term housing prices are under great pressure

.

Now the questionnaire is systematically summarized for the reference of the industry and the community

.

⑥ The situation of home buyers in 2021: the willingness of home buyers in 2021 is still strong, the post-85s and post-90s are the main groups of home buyers, and the Pearl River Delta and Beijing Tianjin Hebei regions are favored by home buyers

.

69% of the respondents gave a positive answer to the obvious decline in the demand for house purchase, but their overall willingness to buy houses decreased by 20 percentage points compared with that of last month

.

The proportion of respondents who expect house price to rise this month continues to rise to 34%, reaching a new level in the past six months, and the proportion of falling expectation drops to 15%, reaching a periodic low

.

This survey relies on the CREIS middle finger cloud research platform to form a questionnaire

.

The overall expectation of house price is bullish ➤ overall: the proportion of rising expectation rises, while the proportion of falling expectation weakens

.

Chart: Respondents’ income expectations for the next year in January 2021 (different energy levels) ➤ different regions: the Pearl River Delta and the Yangtze River Delta are optimistic, the Central Plains and Guanzhong are pessimistic, and the income expectations are optimistic: the respondents in the Pearl River Delta and the Yangtze River Delta are most optimistic about the future, and more than 70% of the respondents expect their income to increase or remain unchanged in the next year, of which more than 50% in the Pearl River Delta Respondents believe that their income will increase in the next year; their income expectations are pessimistic: respondents in Central Plains and Guanzhong are pessimistic about their future expectations, and about 37% of respondents believe that their income will decrease or have uncertainty in the next year, which is much higher than that in other regions.

.

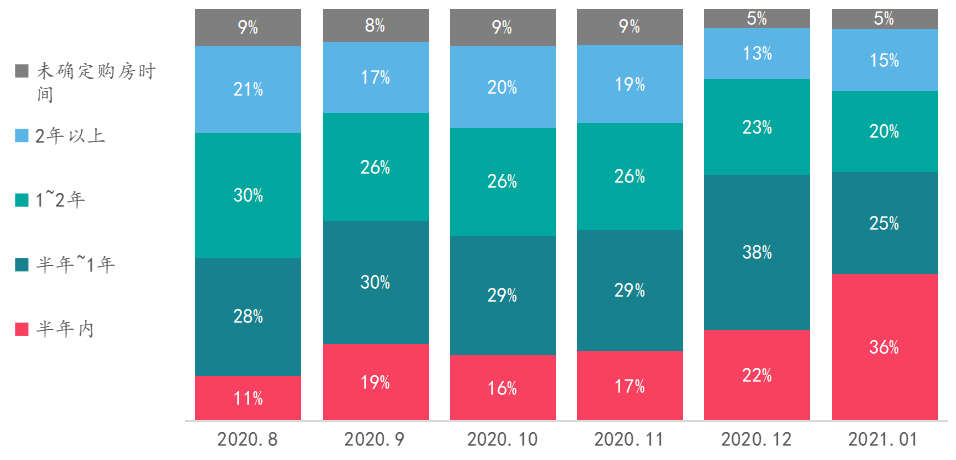

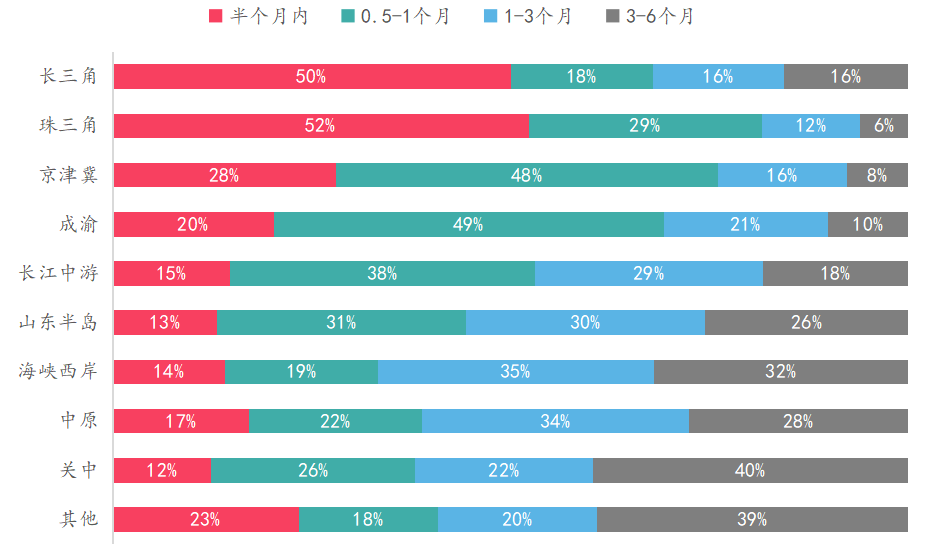

Figure: time distribution of house purchase plan from August 2020 to January 2021 has your future expectation increased? 1

.

As always, the interviewees participating in the survey are still quite representative

.

From the perspective of sub level, the proportion of respondents with house purchase plans in cities with different levels decreased to varying degrees, with the county town having the largest decline, reaching 27%, and the third and fourth tier cities with 26% From the perspective of different regions, the proportion of respondents planning to buy houses in each region decreased to a large extent compared with that of last month, and the decline in the middle reaches of the Yangtze River, both sides of the Taiwan Strait and Guanzhong was more obvious, with a decline of more than 25%

.

Figure: Respondents’ income expectations for the next year from August 2020 to January 2021 ➤ cities with different energy levels: more than 70% of respondents in the first and second tier cities have optimistic income expectations, while those in the county towns are pessimistic

.

The respondents in Yangtze River Delta, middle reaches of Yangtze River and both sides of the Taiwan Strait believe that the probability of housing price decline is small, and the overall proportion is only about 10%

.

The pace of buying houses is ahead of schedule, and the willingness of buyers to buy houses within half a year rises sharply: in January 2021, 36% of planned buyers are ready to buy houses within half a year, 14 percentage points higher than that of the previous month The housing plan is ahead of schedule

.

① expected rise: more than 50% of respondents in the Yangtze River Delta believe that housing prices will continue to rise in the next half year, accounting for the highest proportion among the major regions; while Beijing Tianjin Hebei is only 27% Respondents believe that house prices will rise in the future, accounting for the lowest proportion

.

(1) 53% of respondents in the first-line cities believe that housing prices in the first-line cities will still rise in the next half year, far higher than those in other energy level cities, and housing in the first-line cities is still the asset value preservation and increase in the eyes of respondents Secondly, 52% of the respondents in the second tier cities think that the housing prices of their cities will fall in the next half year, which is significantly higher than that of other cities

.

Future income expectations are relatively optimistic ➤ overall: 44% of respondents expect that their income will increase in the next year

.

Figure: Respondents’ expectations of housing price changes in their cities in the next half year from August 2020 to January 2021 ➤ cities with different energy levels: the first-line rising expectation is still significant, while the second-line falling expectation is the most obvious

.

Only about 50% of them expect their income to remain unchanged or increase

.

Figure: in January 2021, respondents’ expectations of housing price changes in their cities in the next half year (different regions) 2

.

✎ key points: ① the pace of house purchase is ahead of schedule: in January, the overall pace of house purchase of home buyers with house purchase plans is ahead of schedule, and the proportion of those who are ready to buy houses within half a year reaches 36%, which is 14 percentage points higher than that of last month

.

④ Stable policy expectation: 43% of the respondents expected that the property market policy would remain stable in the future, and the proportion of expected tightening and loosening would decline

.

Figure: proportion of respondents’ age and city energy level in January 2021 figure: heat map of respondents’ City Distribution in January 2021 is your housing plan on the agenda? 1

.

34% of them are not clear about their future income changes or expected unemployment, which is far more than the other three cities

.

② Expected decline: more than 20% of the respondents in Beijing Tianjin Hebei region believe that the housing prices in their regions will continue to decline in the next six months, and they are pessimistic about the future real estate market

.