Opponents say that the rice circle culture is a product of the Internet era, which is not conducive to the normal management and operation of fund managers

.

By the end of 2020, the mixed scale of e-fonda’s medium and small cap Market managed by Zhang Kun is 40.111 billion yuan, and the mixed scale of e-fonda’s blue chip selection is 67.701 billion yuan

.

” Fund management is a kind of professional investment behavior, but according to the interviewees contacted by sina finance, most of them have not received systematic financial theory training, and 2020 is also the first year for them to start practical operation

.

The people are making dreams, and the fund companies are “making gods”

.

Wang Li, who works in the insurance industry in Yunnan, told sina finance that she first entered the stock market and fund market in early 2020

.

The new foundation “Sunlight” launched by the fund companies is making hundreds of billions of funds

.

At the same time, on these social platforms, some netizens also exposed that some fund big V had “leek cutting” behavior, including inducing fans to pay in the name of teaching financial management

.

Surrounded by the fanatical market atmosphere, personal bloggers under the banner of “financial management” have attracted many fans

.

In addition to the frequent occurrence of “sunshine base”, the new fund raised an average of 10 billion yuan, with an increase of more than 100 billion yuan during the week

.

On Weibo, Jimin also opened Chaohua for Zhang Kun, the fund manager of e-fonda, and set up a fan support association, calling itself “ikun”

.

Is this another trap of harvesting “new leeks”? For example, station B blogger “Xiaoyu brother who likes to play with funds” continued to share his fund’s resumption through the platform, and gained nearly 700000 fans in just one year

.

“For the relevant businesses that need to be licensed, the platform should perform the audit obligation higher than that of ordinary businesses

.

However, after contacting some new entrants, sina finance found that most of them had not received systematic financial theory training, and they still had a choice to understand the fund, mainly following the advice of friends, family members or short video platform big v

.

Before the end of January, there were more than 20 10 billion newly sold funds.

.

Netizens who hold Zhang Kun’s Fund in charge sign in and clock out in Weibo Chaohua, calling themselves “ikun”, and the fund circle is gradually becoming a circle

.

The market is hot, but the fund big V “stops” behind the national carnival, the number of microblog fund super words reading in social platform exceeds 1.2 billion

.

Another post-90s investor in Guangzhou said that his purchase of funds mainly depends on the recommendation of financial management platform and the sharing of fund big v

.

However, when Xiaoyu fans are looking forward to the update, the blogger announced the suspension of the update at station B

.

It is found that reliable fund managers can invest, but they can take a long-term view and find the strengths of different fund managers

.

Since the post-90s have been running for nearly half a year, “fund” has become a good opening topic in social communication

.

Bring the rice circle culture into the fund circle, and this new way of playing also promotes the fund to go out of the circle again and again

.

It is worth noting that, according to the report of China’s household wealth index in the second quarter, in the post epidemic era, China’s demand for online financial management has greatly increased, and the money has been saved less, so it is more willing to buy funds than stocks

.

For these new entrants, the fund not only has the investment function, but also has the social attribute

.

Zhang Kun, the fund manager mentioned above, has attracted much attention because of his large scale of management and his move to adjust positions

.

As of press release, “e-fonda Zhang Kun” has more than 5000 fans and tens of millions of readers

.

” The fund market has created many “most” cases

.

And said that “let Xiaobai to speculate in stocks, and even Hong Kong and US stocks, that is to push Xiaobai into the pit of fire.”

.

If there is no relevant license, the platform should be cleaned up immediately, otherwise, in addition to the relevant number owner, the platform itself may also be suspected of violating the rules

.

Some supporters believe that “serious things are entertaining, and a friend of Jimin is equivalent to buying a blind box fund manager or calling a beloved fund manager.” In this regard, the sponsor of Zhang Kun’s support association once sent a micro blog warning, “don’t really use powder circle thinking to make investment

.

Fund, blue chip, Zhang Kun, in recent days, these topics have dominated the microblog hot search list

.

Xu Feng, director of Shanghai Jiucheng law firm, told sina finance that if the (blogger) behavior involves buying and selling suggestions, investment forecast analysis, etc., it is suspected of engaging in securities business in violation of regulations

.

It sent the “blue chip” to the hot search at one stroke, and many funders jokingly called it “eternal God” in the comment area

.

But what does the gradual “rice circle” fund circle mean for fund companies, fund managers or investors? With Zhang Kunchao’s words becoming more and more popular, “is it a good phenomenon for the fund circle to become a rice circle?” The topic caused a lot of hot discussion among netizens

.

“I’m Xiaobai

.

In response to the latest video, the owner replied that he would respond to the knowledge planet, and the time cost should be paid accordingly

.

There are friends who have questioned the “hard core, strong and less” knowledge content of the 299 yuan content of the planet, and even official account to guide fans to open accounts, even the accounts of the US and Hong Kong

.

Since the second half of 2020, the fund market continues to refresh the topic

.

In other words, the post-90s are running into the market

.

In the first week of 2021, new funds will continue to be issued

.

Xiaohongshu search “fund” has 210000 related notes, stock related only 170000

.

Therefore, he is also considered as a new public offering elder brother

.

The hot search on the Internet often brings pressure to them, and whether it can be changed into motivation is unknown

.

The rising fan data has generated grey areas such as group opening, charging and operation guidance

.

Did you buy a base? Which one did you buy? Do you have a recommended fund? These conversations have become the conversation materials of the post-90s and a part of their social life

.

In 2020, the proportion of young people under the age of 30 will be 52.9%

.

These “ikuns” are keen to punch in and share daily fund operations in Chaohua

.

For the fund’s cognition, there are still choices, mainly listening to the suggestions of friends, family or short video platform big v

.

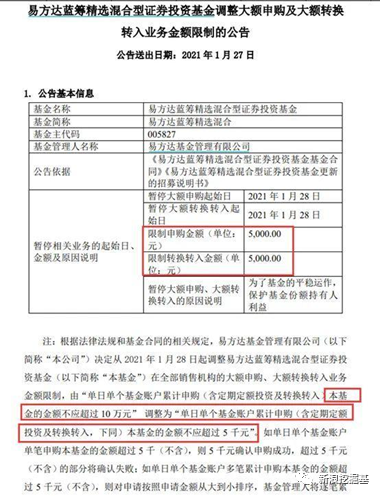

On January 25, e-fonda’s blue chip selection valuation was only more than 1 point, but the actual net value was more than 5 points

.

The stock operation mainly follows the investment in the app of securities companies, while the purchase of funds still refers to the opinions of parents

.

Zhang Kun, known as the new “big brother of public offering”, has a fan support club on Weibo

.

In the little red book, there are netizens sort out a few fund bloggers, said “copy with the homework” can

.

According to the recently disclosed Fund Quarterly Report, Zhang Kun’s Fund under management has reached 125.509 billion yuan, which is the first fund manager in the history of public funds to manage over 100 billion yuan of active equity funds

.

They can diversify investment and have less risk

.

Several 10 billion new funds, including sunray and fund companies, are busy promoting the champion by “creating God”, and the post-90s rush into the market, occupying half of the new funders

.

Another B station up main “hard core strong less” with 6 million people to buy the fund set up, has 210000 fans

.

According to the statistics of China Securities Investment Fund Association, as of the end of December 2020, the public offering funds have invested 5.22 trillion yuan in stocks, of which the total market value of a shares is 4.80 trillion yuan, accounting for 7.58% of the total market value of Shanghai and Shenzhen stock exchanges, which is the highest level in recent 10 years

.

As for the official account, the fee is not “B” fans

.

As of January 15 this year, the total scale of public funds has exceeded the threshold of 20 trillion yuan and equity funds has exceeded 7 trillion yuan, both of which have reached a record high

.

Can I enter now?” It’s also one of the most popular comments about funds on social platforms

.

At the same time, they will also make expression bags with festive patterns for Zhang Kun to cheer him up

.

As many as 14 funds will be closed in advance, and 9 of them will be sold out in one day

.

According to Article 118 of the new securities law, no unit or individual may carry out securities business activities in the name of a securities company without the approval of the securities regulatory authority under the State Council

.

According to the official account, it can be seen that the stop is more related to the B station management method, mainly related to paying for knowledge online and holding qualification certificates

.