If we invest in the market, we should not only recognize the past, but also embrace the future

.

Industrial opportunities are constantly breeding in our market

.

We can see their traces from the daily trading board, and we can also confirm their existence from the quarterly reports of future companies

.

The difference is that the trading board in the market always exaggerates to reflect the expectation, and it is easy to set at a high point after chasing after buying, and there is a risk of falsification in the development of the industry; while the substantial growth of financial report and business data often lags behind to reflect the expectation, and when we realize that the stock price may have already doubled, the price performance ratio will be greatly reduced if we buy again at this time

.

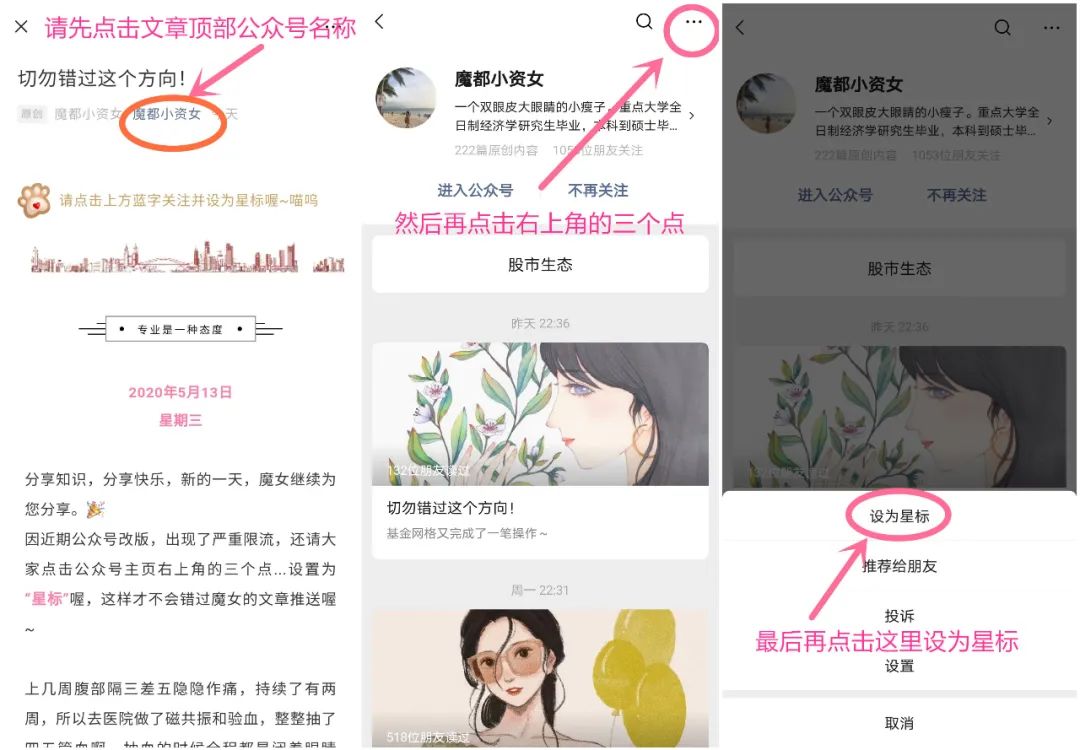

Please click on the blue word above and set it as a star sign

.

Oh, meow, professional is an attitude

.

Good Wednesday, Wednesday

.

I am Shu Wen, sharing knowledge and sharing happiness

.

I will continue to share with you a new day

.

I have been sharing it with you

.

Because of the recent official account revision, there has been serious current restriction

.

Please click on the three points in the top right-hand corner of the official account, and set it as “star sign” so that we can not miss it

.

Article push Oh ~ today is a vigorous rise, several major stock indexes once again refresh the current round of market high

.

Although it is still only a small number of leading companies, it is not as extreme as before from the perspective of major plates

.

At least today, it is no longer the solo dance of wine making or new energy, but the internal differentiation of plates is more obvious

.

The first is the liquor making sector

.

After continuous strong and irrational rise, today’s sector has finally made a substantial adjustment

.

However, within the sector, Guizhou Maotai, Wuliangye, Shanxi Fenjiu and other industry leaders are still strong red, leading to the sharp decline of some second – and third tier liquor companies

.

Secondly, we can see the cement sector

.

Finally, it has changed its weakness in the early stage, and today’s overall close is up, while the leading companies are not Conch cement is up 7.86%; and the banking sector, which has been criticized for a long time, has finally rebounded, and the top two in terms of growth are the two I have been optimistic about: China Merchants Bank and Ping An Bank

.

So today, no matter whether the overall plate is up or down, the high-quality leading companies in most industries have performed well

.

So far, the old investors are guessing when the market will peak and always ready to leave

.

It’s right to have this sense of risk

.

But in another area, the new fund issuance market did reappear a hot boom

.

Since January 4, funds burst out in an endless stream

.

On the first day, four new funds were sold out in one day, attracting more than 50 billion funds in total

.

On January 5, Yinhua’s new funds attracted 13 billion subscription and sold out in one day

.

Today, Xingzheng global and Qianhai Kaiyuan’s new funds are sold out in one day, attracting more than 20 billion subscription

.

It can be said that although the market has made us feel guilty, external funds are still running into the market

.

The biggest difference between this round of market and 5 years ago or 10 years ago is: in the past, the way of incremental funds entering the market was to sweep the low price stocks in the A-share market

.

After the bull market began, it became normal to eliminate “1 Yuan stocks” and “2 Yuan stocks”; but at the beginning of this round of market, the way of incremental funds entering the market was through fund allocation, and the position allocation of new funds was often to continue to buy the positions of their own old funds

.

The original old fund, originally holding the industry leader, so the original leading stocks are constantly pushed up, and the polarization between ordinary small cap stocks is increasing

.

Although this kind of unlimited group will eventually come to an end, although some high-quality small stocks will also usher in a make-up, but the timing of the transformation can not be judged for the time being

.

As in-depth participants in the market, we should divide the individual stocks in the recent market into three categories and treat them differently: the first category is the industry leaders that have been constantly promoted, such as Guizhou Maotai, Hengrui medicine, Midea Group, Ningde times, etc

.

my opinion is that if we can hold these stocks, we should try our best to hold them, but we should not hold them at a high position

.

If you really can’t hold it, you can sell it and replace it with a low-level industry leader

.

Although their valuation is not low, we can not predict when the trend will end and only embrace bubbles

.

The second category is the following trend of short-term funds to promote the following stocks, or pure theme stocks, such as two or three line Baijiu, struggling around the edge of the profit and loss of some military stocks

.

They have also risen a lot recently, but their fundamentals are not bright

.

As for this category, I think it can be abandoned

.

Don’t enter the market again before the end of this round

.

They have no medium-term investment value

.

If you want to make a band, you should wait for a correction instead of getting on at the high point now

.

The third category is the industry leaders or high-quality coupons abandoned by funds, such as banking, insurance and real estate, and the technology stocks with deep adjustment and good prospects

.

For them, I think we should be patient first

.

Since the first class of stocks are afraid to catch up, the third class of stocks is the first choice

.

In addition, we should pay more attention to tracking them

.

Even if the funds do not pay attention to them for the time being, with the disclosure of the annual report and even the first quarter report, companies with good performance will eventually have the opportunity to perform in 2021

.

Generally speaking, we don’t guess the top of this round of market, because there is only one top of the bull market, and all previous adjustments are diving; but we also don’t want to increase leverage, no matter how optimistic we are about the next market

.

Because no matter how much profit is made in the early stage, it will be exhausted due to the high position increase

.

Once the market enters the adjustment, the high position increase will quickly return all profits and make investors regret There is no opportunity for the leading companies to open their positions, so we can focus on the newly listed new stocks

.

In recent years, many high-quality sub new companies have started the rising market: for example, Ganli pharmaceutical, which was adjusted to below 70 billion in the early stage, has risen sharply in recent years, with its market value approaching 90 billion again; and Zhongtian rocket has also increased by more than 30% in the recent month

.

This kind of stock as long as in a reasonable range of valuation intervention, generally easy to have good earnings

.

The stock I share today may be a little less famous, but it also has a lot of highlights

.

This one is huichuangda

.

Huichuangda was founded in 2004

.

Its main business is the R & D, design, production and sales of light guide structures and components, precision key switch structures and components

.

Its main products include light guide films, backlight modules and other light guide structures and components, and metal film switches, ultra small waterproof touch switches and other precision key switch structures and components

.

The company has 73 authorized patents, including 10 invention patents, 61 utility model patents and 2 design patents

.

In the field of backlight of notebook input devices, the company has successively passed the certification of qualified suppliers of global well-known notebook keyboard manufacturers such as Qun optoelectronics and Dafang electronics, and finally applied it to mainstream notebook brands such as Lenovo, HP, Dell and ASUS

.

At the same time, the company also provides light guide film, light guide film and light guide film for global well-known enterprises such as Huawei, oppo, Xiaomi and Alibaba Metal membrane switch and other functional structural parts

.

The company has successfully developed and produced ultra small waterproof light touch switch, breaking through the technical barriers of foreign ultra small waterproof light touch switch, and realizing the domestic substitution of related products

.

Based on the operation and development of the company in recent years, the backlight field is the reason for the continuous release of the company’s performance, especially the backlight module’s global market share in luminous keyboards

.

The company has greatly increased from 5.47% in 2016 to 23.15% in 2019, which can be regarded as the leader in this field, showing the company’s outstanding technical strength

.

But at the same time, with the general trend of mobile phone full screen, the application demand of light guide film in mobile phone is greatly reduced, which is a hidden worry, and also one of the reasons for the weak stock price of the company after listing

.

But we also need to understand that this technology change will not be completed immediately, the company’s current orders are still sufficient, and the company’s business in the field of ultra small waterproof light touch switch has started to expand, which will constitute a new growth point of performance.

.